HP 2015 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

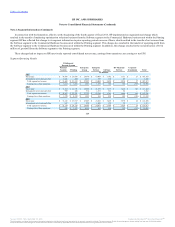

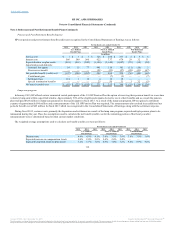

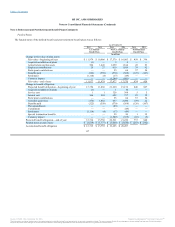

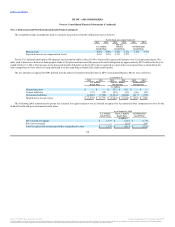

HP derives the results of the business segments directly from its internal management reporting system. The accounting policies HP uses to derive

segment results are substantially the same as those the consolidated company uses. Management measures the performance of each segment based on several

metrics, including earnings from operations. Management uses these results, in part, to evaluate the performance of, and to allocate resources to, each of the

segments.

Segment revenue includes revenues from sales to external customers and intersegment revenues that reflect transactions between the segments on an

arm's-length basis. Intersegment revenues primarily consist of sales of hardware and software that are sourced internally and, in the majority of the cases, are

financed as operating leases by HPFS. HP's consolidated net revenue is derived and reported after the elimination of intersegment revenues from such

arrangements.

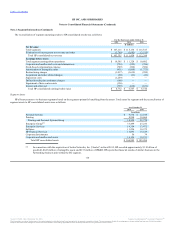

HP periodically engages in intercompany advanced royalty payment and licensing arrangements that may result in advance payments between

subsidiaries. Revenues from these intercompany arrangements are deferred and recognized as earned over the term of the arrangement by the HP legal entities

involved in such transactions; however, these advanced payments are eliminated from revenues as reported by HP and its business segments. As disclosed in

Note 6, during fiscal 2015, HP executed an intercompany advanced royalty payment arrangement resulting in advanced payments of $8.8 billion, while

during fiscal 2014 HP executed a multi-year intercompany licensing arrangement and intercompany advanced royalty payment arrangement which resulted

in combined advanced payments of $11.5 billion. In these transactions, the payments were received in the U.S. from a foreign consolidated affiliate, with a

deferral of intercompany revenues over the term of the arrangements, approximately 5 years and 15 years, respectively. The impact of these intercompany

arrangements is eliminated from both HP consolidated and segment revenues.

Financing interest in the Consolidated Statements of Earnings reflects interest expense on debt attributable to HPFS. Debt attributable to HPFS consists

of intercompany equity that is treated as debt for segment reporting purposes, intercompany debt, and borrowing- and funding-related activity associated

with HPFS and its subsidiaries.

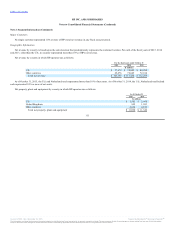

HP does not allocate to its segments certain operating expenses, which it manages at the corporate level. These unallocated costs include certain

corporate governance costs, stock-based compensation expense, amortization of intangible assets, restructuring charges, acquisition and other related

charges, separation costs, defined benefit plan settlement charges and impairment of data center assets.

Effective at the beginning of the first quarter of fiscal 2015, HP implemented an organizational change to align its segment financial reporting more

closely with its current business structure. This organizational change resulted in the transfer of third-party multi-vendor support arrangements from the

Technology Services ("TS") business unit within the EG segment to the ITO business unit within the ES segment. HP has reflected this change to its segment

information retrospectively to the earliest period presented, which has resulted in the removal of intersegment revenue from the TS business unit within the

EG segment and the related corporate intersegment revenue eliminations, and the transfer of operating profit from the TS business unit within the EG segment

to the ITO business unit within the ES segment.

108

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.