HP 2015 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240

|

|

Table of Contents

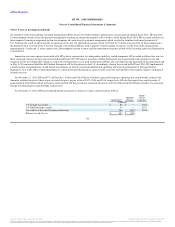

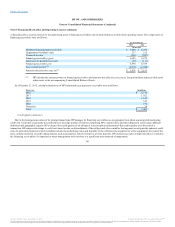

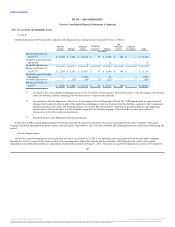

collateralized by a security interest in the underlying assets. Financing receivables also include billed receivables from operating leases. The components of

financing receivables were as follows:

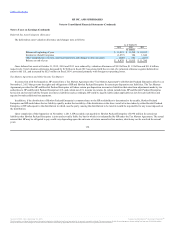

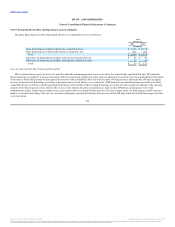

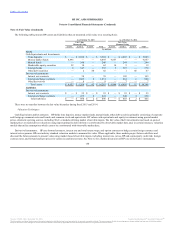

As of October 31, 2015, scheduled maturities of HP's minimum lease payments receivable were as follows:

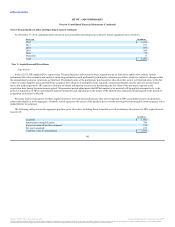

Due to the homogenous nature of its leasing transactions, HP manages its financing receivables on an aggregate basis when assessing and monitoring

credit risk. Credit risk is generally diversified due to the large number of entities comprising HP's customer base and their dispersion across many different

industries and geographic regions. HP evaluates the credit quality of an obligor at lease inception and monitors that credit quality over the term of a

transaction. HP assigns risk ratings to each lease based on the creditworthiness of the obligor and other variables that augment or mitigate the inherent credit

risk of a particular transaction. Such variables include the underlying value and liquidity of the collateral, the essential use of the equipment, the term of the

lease, and the inclusion of credit enhancements, such as guarantees, letters of credit or security deposits. HP classifies accounts as high risk when it considers

the financing receivable to be impaired or when management believes there is a significant near-term risk of impairment.

141

Minimum lease payments receivable $ 7,000 $ 6,982

Unguaranteed residual value 217 235

Unearned income (528) (547)

Financing receivables, gross 6,689 6,670

Allowance for doubtful accounts (95) (111)

Financing receivables, net 6,594 6,559

Less: current portion(1) (2,918) (2,946)

Amounts due after one year, net(1) $ 3,676 $ 3,613

(1) HP includes the current portion in Financing receivables and amounts due after one year, net in Long-term financing receivables and

other assets in the accompanying Consolidated Balance Sheets.

2016 $ 3,176

2017 1,922

2018 1,144

2019 526

2020 194

Thereafter 38

Total $ 7,000

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.