HP 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

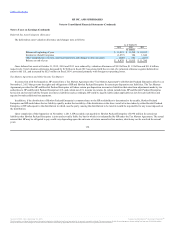

tax treatment of the intercompany licensing arrangements differs from U.S. GAAP treatment, deferred taxes are recognized. During fiscal 2015, HP executed

an intercompany advanced royalty payment arrangement resulting in advanced payments of $8.8 billion, while during fiscal 2014, HP executed a multi-year

intercompany licensing arrangement and an intercompany advanced royalty payment arrangement which resulted in combined advanced payments of

$11.5 billion, the result of which was the recognition of zero net U.S. deferred tax assets in fiscal 2015 and $1.7 billion in fiscal 2014. In these transactions,

the payments were received in the U.S. from a foreign consolidated affiliate, with a deferral of intercompany revenues over the term of the arrangements,

approximately 5 years and 15 years, respectively. Intercompany royalty revenue and the amortization expense related to the licensing rights are eliminated in

consolidation.

Separation costs are expenses associated with HP's plan to separate into two independent publicly-traded companies. HP recorded a deferred tax asset on

these costs and expenses as they were incurred through fiscal 2015. HP expects a portion of these deferred tax assets associated with separation costs and

expenses will be non-deductible expenses, at the time the Separation is executed. Furthermore, HP has also concluded on the legal form of the Separation and

in May 2015 announced that Hewlett Packard Enterprise will be the spinnee in the U.S. Accordingly, during the second half of fiscal 2015, HP implemented

certain internal reorganizations of, and transactions among, its wholly owned subsidiaries and operating activities in preparation for the legal form of

Separation. As a result, HP recorded adjustments to certain deferred and prepaid tax assets as well as income tax liabilities reflecting the impact of separation

related activities.

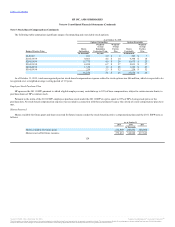

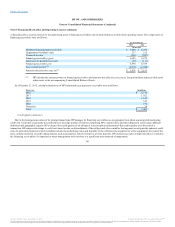

As of October 31, 2015, HP had $971 million, $6.1 billion and $26.8 billion of federal, state and foreign net operating loss carryforwards, respectively.

Amounts included in each of these respective totals begin to expire in fiscal 2023, 2016 and 2016, respectively. HP also has capital loss carryforwards of

approximately $26 million which will expire in fiscal 2020. HP has provided a valuation allowance of $106 million and $8.2 billion related to the state and

foreign net operating loss carryforwards, respectively.

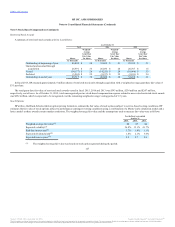

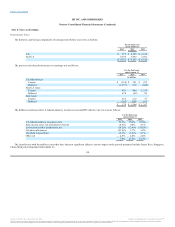

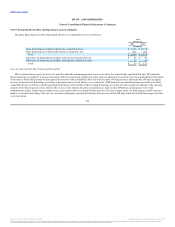

As of October 31, 2015, HP had recorded deferred tax assets for various tax credit carryforwards as follows:

135

U.S. foreign tax credits $ 46 $ — 2021

U.S. R&D and other credits 47 — 2017

Tax credits in state and foreign jurisdictions 360 (223) 2016

Balance at end of year $ 453 $ (223)

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.