HP 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

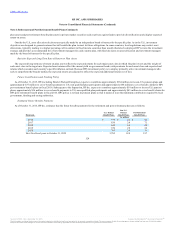

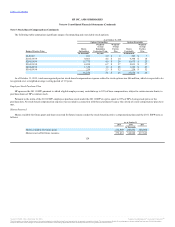

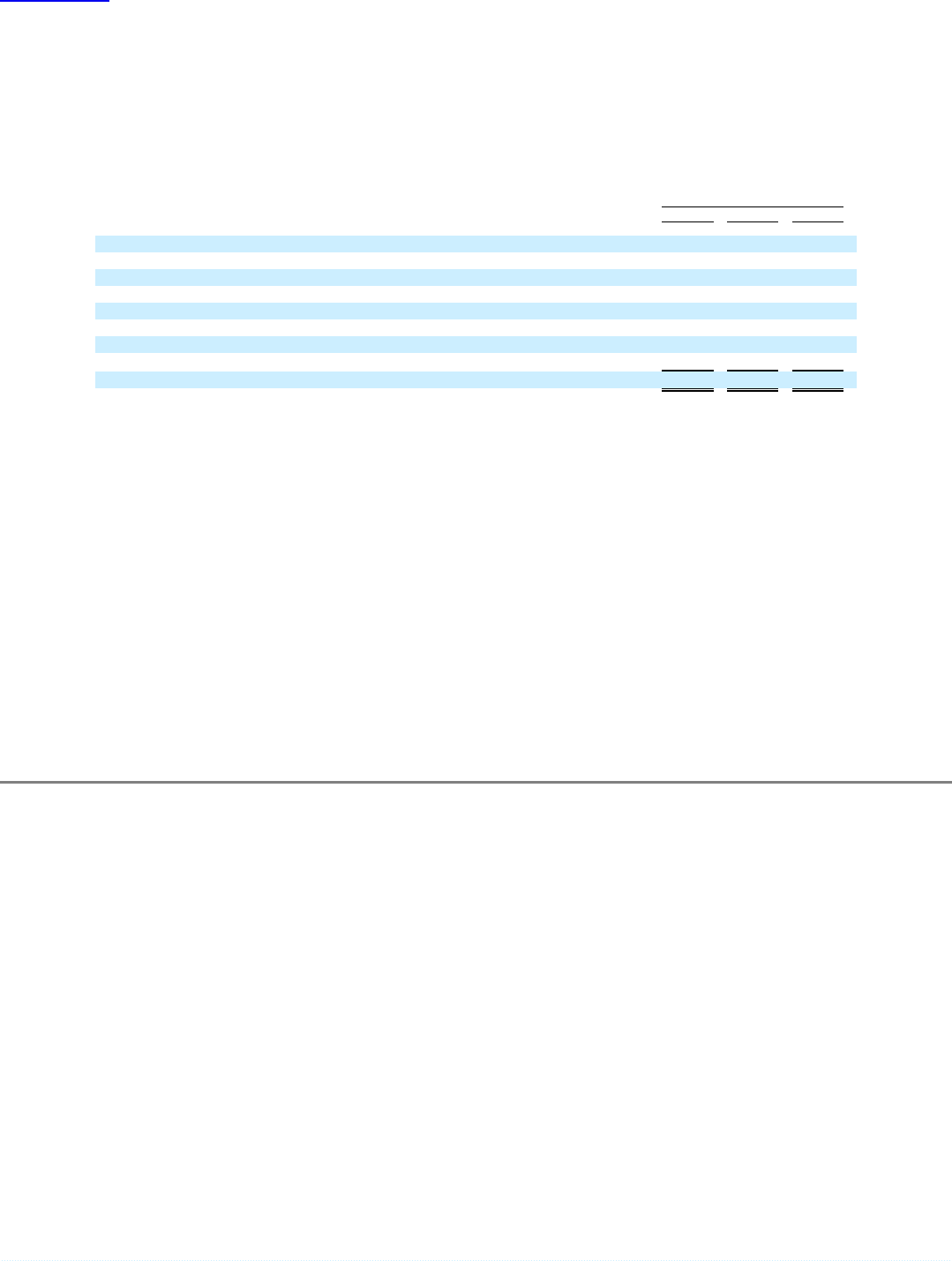

A reconciliation of unrecognized tax benefits is as follows:

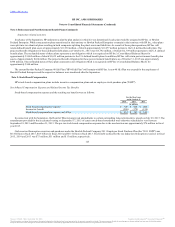

Up to $3.0 billion, $2.2 billion and $1.9 billion of HP's unrecognized tax benefits at October 31, 2015, 2014 and 2013, respectively, would affect HP's

effective tax rate if realized. The $5.8 billion increase in the amount of unrecognized tax benefits for the year ended October 31, 2015 primarily relates to the

timing of intercompany royalty income recognition which does not affect HP's effective tax rate.

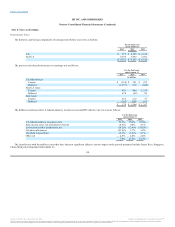

HP recognizes interest income from favorable settlements and interest expense and penalties accrued on unrecognized tax benefits in Provision for taxes

in the Consolidated Statements of Earnings. HP had accrued $357 million and $254 million for interest and penalties as of October 31, 2015 and 2014,

respectively.

HP engages in continuous discussion and negotiation with taxing authorities regarding tax matters in various jurisdictions. HP does not expect complete

resolution of any U.S. Internal Revenue Service ("IRS") audit cycle within the next 12 months. However, it is reasonably possible that certain federal, foreign

and state tax issues may be concluded in the next 12 months, including issues involving transfer pricing and other matters. Accordingly, HP believes it is

reasonably possible that its existing unrecognized tax benefits may be reduced by an amount up to $144 million within the next 12 months.

HP is subject to income tax in the U.S. and approximately 105 other countries and is subject to routine corporate income tax audits in many of these

jurisdictions. In addition, HP is subject to numerous ongoing audits by federal, state and foreign tax authorities. The IRS is conducting an audit of HP's 2009,

2010, 2011, 2012, 2013 and 2014 income tax returns. HP has received from the IRS Notices of Deficiency for its fiscal 1999, 2000, 2003, 2004 and 2005 tax

years, and Revenue Agent Reports ("RAR") for its fiscal 2001, 2002, 2006, 2007 and 2008 tax years. The proposed IRS adjustments for these tax years would,

if sustained, reduce the benefits of tax refund claims HP has filed for net operating loss carrybacks to earlier fiscal years and tax credit carryforwards to

subsequent years by approximately $445 million. In addition, HP expects the IRS to issue an RAR for 2009 through 2011 relating to certain tax positions

taken on the filed tax returns, including matters related to the U.S. taxation of certain intercompany loans. While the RAR may be material in amount, HP

132

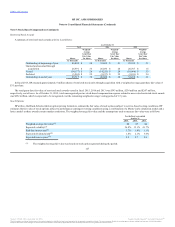

Balance at beginning of year $ 4,128 $ 3,484 $ 2,573

Increases:

For current year's tax positions 1,942 304 290

For prior years' tax positions 4,673 593 997

Decreases:

For prior years' tax positions (655) (125) (146)

Statute of limitations expirations (21) (46) (11)

Settlements with taxing authorities (90) (82) (219)

Balance at end of year $ 9,977 $ 4,128 $ 3,484

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.