HP 2015 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2015 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

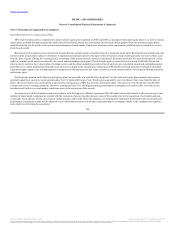

the extent that HP plans to reinvest earnings of these jurisdictions indefinitely outside the United States, U.S. taxes have not been provided on those

indefinitely reinvested earnings.

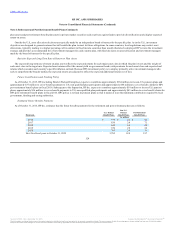

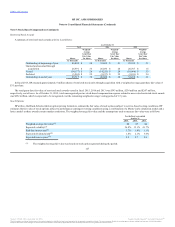

In fiscal 2015, HP recorded $1.6 billion of net income tax benefits related to items unique to the year. These amounts included $1.8 billion tax benefit

due to a release of valuation allowances pertaining to certain U.S. deferred tax assets and $486 million tax charge to record valuation allowances on certain

foreign deferred tax assets, both related to legal entities within the ES business, $394 million of tax charges for adjustments to uncertain tax positions and the

settlement of tax audit matters, inclusive of $449 million of tax charges related to pension transfers, and $3 million of tax charges for various provision to

return adjustments and other adjustments. In addition, HP recorded $639 million of net tax benefits on restructuring, separation-related, and other charges and

a tax benefit of $47 million arising from the retroactive research and development credit resulting from the Tax Increase Prevention Act of 2014, which was

signed into law in December 2014.

In fiscal 2014, HP recorded $53 million of net income tax charges related to items unique to the year.

In fiscal 2013, HP recorded $471 million of net income tax charges related to items unique to the year. These amounts included $214 million of net

increases to valuation allowances, $406 million of tax charges for adjustments to uncertain tax positions and the settlement of tax audit matters and

$47 million of tax charges for various prior period adjustments. In addition, HP recorded $146 million of tax benefits from adjustments to prior year foreign

income tax accruals and a tax benefit of $50 million arising from the retroactive research and development credit resulting from the American Taxpayer

Relief Act of 2012, which was signed into law in January 2013.

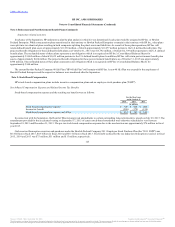

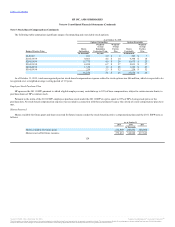

As a result of certain employment actions and capital investments HP has undertaken, income from manufacturing and services in certain countries is

subject to reduced tax rates, and in some cases is wholly exempt from taxes, through 2026. The gross income tax benefits attributable to these actions and

investments were estimated to be $581 million ($0.32 diluted net EPS) in fiscal year 2015, $1.2 billion ($0.61 diluted net EPS) in fiscal 2014, $827 million

($0.42 diluted net EPS) in fiscal year 2013. The gross income tax benefits were offset partially by accruals of U.S. income taxes on undistributed earnings,

among other factors.

131

Source: HP INC, 10-K, December 16, 2015 Powered by Morningstar® Document Research℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.