Google 2009 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

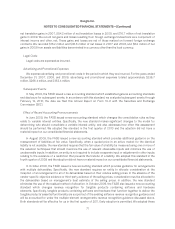

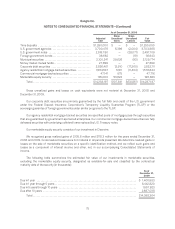

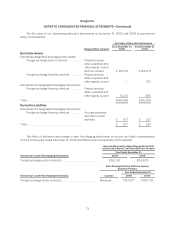

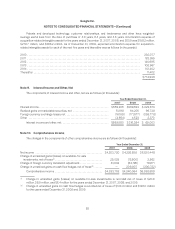

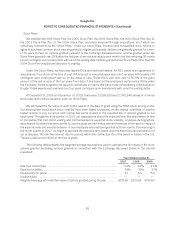

Gains (Losses) Recognized in Income on

Derivatives (Ineffective Portion and Amount

Excluded from Effectiveness Testing)1

Year Ended December 31,

Derivatives in Cash Flow Hedging Relationship Location 2008 2009

Foreign exchange option contracts ............................... Interest income

and other, net $(136,013) $(267,984)

1Gains (losses) related to the ineffectiveness portion of the hedges were not material in all periods presented.

The effect of derivative instruments in fair value hedging relationship on income for the year ended

December 31, 2009 is summarized below (in thousands):

Gains (Losses) Recognized in Income on Derivatives2

Derivatives in Fair Value Hedging Relationship Location 2009

Foreign exchange forward contracts ......................... Interest income and

other, net $2,169

Hedged item .............................................. Interest income and

other, net (2,181)

Total ..................................................... $ (12)

2Gains (losses) related to the ineffectiveness portion and the amount excluded from effectiveness testing of

the hedges were not material.

The effect of derivative instruments not designated as hedging instruments on income for the years ended

December 31, 2008 and 2009 is summarized below (in thousands):

Gains (Losses) Recognized in Income on Derivatives

Year Ended December 31,

Derivatives Not Designated As Hedging Instruments Location 2008 2009

Foreign exchange forward contracts ....................... Interest income

and other, net $145,250 $(77,656)

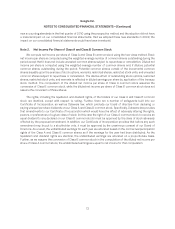

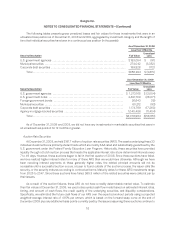

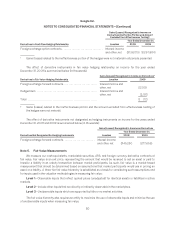

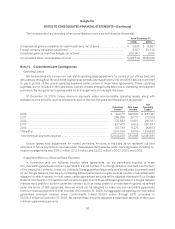

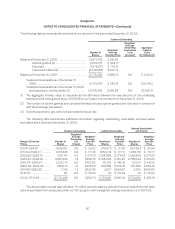

Note 5. Fair Value Measurements

We measure our cash equivalents, marketable securities, ARS, and foreign currency derivative contracts at

fair value. Fair value is an exit price, representing the amount that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based

measurement that should be determined based on assumptions that market participants would use in pricing an

asset or a liability. A three-tier fair value hierarchy is established as a basis for considering such assumptions and

for inputs used in the valuation methodologies in measuring fair value:

Level 1—Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active

markets.

Level 2—Include other inputs that are directly or indirectly observable in the marketplace.

Level 3—Unobservable inputs which are supported by little or no market activities.

The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use

of unobservable inputs when measuring fair value.

80