Google 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Stock Plans

We maintain the 1998 Stock Plan, the 2000 Stock Plan, the 2003 Stock Plan, the 2003 Stock Plan (No. 2),

the 2003 Stock Plan (No. 3), the 2004 Stock Plan, and plans assumed through acquisitions, all of which are

collectively referred to as the “Stock Plans.” Under our Stock Plans, incentive and nonqualified stock options or

rights to purchase common stock may be granted to eligible participants. Options are generally granted for a term

of 10 years. Except for options granted pursuant to the Exchange discussed below, options granted under the

Stock Plans generally vest 25% after the first year of service and ratably each month over the remaining 36 month

period contingent upon employment with us on the vesting date. Options granted under Stock Plans other than the

2004 Stock Plan may be exercised prior to vesting.

Under the Stock Plans, we have also issued RSUs and restricted shares. An RSU award is an agreement to

issue shares of our stock at the time of vest. RSUs issued to new employees vest over four years with a yearly cliff

contingent upon employment with us on the dates of vest. These RSUs vest from zero to 50.0% of the grant

amount at the end of each of the four years from date of hire based on the employee’s performance. RSUs under

the Founders’ Award programs are issued to individuals on teams that have made extraordinary contributions to

Google. These awards vest quarterly over four years contingent upon employment with us on the vesting dates.

At December 31, 2008 and December 31, 2009, there were 23,236,325 and 27,042,948 shares of common

stock reserved for future issuance under our Stock Plans.

We estimated the fair value of each option award on the date of grant using the BSM option pricing model.

Our assumptions about stock-price volatility have been based exclusively on the implied volatilities of publicly

traded options to buy our stock with contractual terms closest to the expected life of options granted to our

employees. Through the third quarter of 2007, our assumptions about the expected term had been based on that

of companies that had option vesting and contractual terms, expected stock volatility, employee demographics,

and physical locations that were similar to ours because we had limited relevant historical information to support

the expected sale and exercise behavior of our employees who had been granted options recently. Commencing in

the fourth quarter of 2007, we began to estimate the expected term based upon the historical exercise behavior of

our employees. The risk-free interest rate for periods within the contractual life of the award is based on the U.S.

Treasury yield curve in effect at the time of grant.

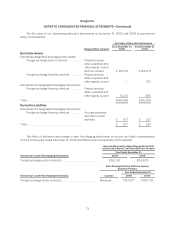

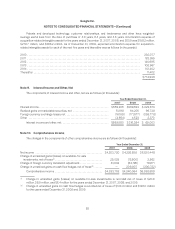

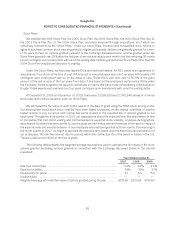

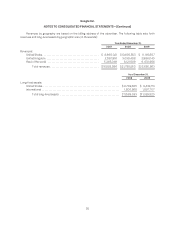

The following table presents the weighted-average assumptions used to estimate the fair values of the stock

options granted (excluding options granted in connection with the Exchange discussed below) in the periods

presented:

Year Ended December 31,

2007 2008 2009

Risk-free interest rate .................................................... 4.4% 3.2% 2.6%

Expected volatility ........................................................ 34% 35% 37%

Expected life (in years) .................................................... 5.1 5.3 5.8

Dividend yield ........................................................... — — —

Weighted-average estimated fair value of options granted during the year ...... $213.56 $203.58 $160.63

89