Google 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

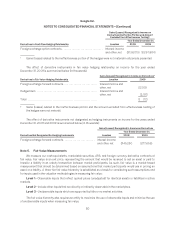

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Property and Equipment

We account for property and equipment at cost less accumulated depreciation and amortization. We compute

depreciation using the straight-line method over the estimated useful lives of the assets, generally two to five

years. We depreciate buildings over periods up to 25 years. We amortize leasehold improvements over the shorter

of the lease term or the estimated useful lives of the assets. Construction in progress is related to the construction

or development of property (including land) and equipment that have not yet been placed in service for their

intended use. Depreciation for equipment commences once it is placed in service and depreciation for buildings

and leasehold improvements commences once they are ready for their intended use.

Software Development Costs

We expense software development costs, including costs to develop software products or the software

component of products to be marketed to external users, before technological feasibility of such products is

reached. We have determined that technological feasibility was reached shortly before the release of those

products and as a result, the development costs incurred after the establishment of technological feasibility and

before the release of those products were not material, and accordingly, were expensed as incurred. Software

development costs also include costs to develop software programs to be used solely to meet our internal needs.

The costs we incurred during the application development stage for these software programs were not material in

the years presented.

Long-Lived Assets Including Goodwill and Other Acquired Intangible Assets

We review property and equipment and intangible assets, excluding goodwill, for impairment whenever events

or changes in circumstances indicate the carrying amount of an asset may not be recoverable. We measure

recoverability of these assets by comparing the carrying amounts to the future undiscounted cash flows the assets

are expected to generate. If property and equipment and intangible assets are considered to be impaired, the

impairment to be recognized equals the amount by which the carrying value of the asset exceeds its fair market

value. We have made no material adjustments to our long-lived assets in any of the years presented. In addition, we

test our goodwill for impairment at least annually or more frequently if events or changes in circumstances

indicate that this asset may be impaired. Our tests are based on our single operating segment and reporting unit

structure. We found no material impairment in any of the years presented.

Intangible assets with definite lives are amortized over their estimated useful lives. We amortize our acquired

intangible assets on a straight-line basis with definite lives over periods ranging primarily from one to 12 years.

Income Taxes

We recognize income taxes under the liability method. We recognize deferred income taxes for differences

between the financial reporting and tax bases of assets and liabilities at enacted statutory tax rates in effect for the

years in which differences are expected to reverse. We recognize the effect on deferred taxes of a change in tax

rates in income in the period that includes the enactment date.

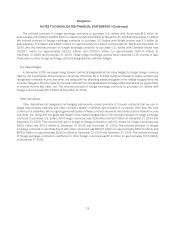

Foreign Currency

Generally, the functional currency of our international subsidiaries is the local currency. We translate the

financial statements of these subsidiaries to U.S. dollars using month-end rates of exchange for assets and

liabilities, and average rates of exchange for revenues, costs, and expenses. We record translation gains and losses

in accumulated other comprehensive income as a component of stockholders’ equity. We recorded $61.0 million of

70