Google 2009 Annual Report Download - page 58

Download and view the complete annual report

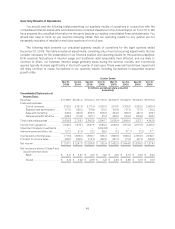

Please find page 58 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Both seasonal fluctuations in internet usage and traditional retail seasonality have affected, and are likely to

continue to affect, our business. Internet usage generally slows during the summer months, and commercial

queries typically increase significantly in the fourth quarter of each year. These seasonal trends have caused, and

will likely continue to cause, fluctuations in our quarterly results, including fluctuations in sequential revenues, as

well as paid click and average cost-per-click growth rates.

The operating margin we realize on revenues generated from ads placed on our Google Network members’

web sites through our AdSense program is significantly lower than the operating margin we realize from revenues

generated from ads placed on our web sites because most of the advertiser fees from ads served on Google

Network members’ web sites are shared with our Google Network members. For the past five years, growth in

advertising revenues from our web sites has generally exceeded that from our Google Network members’ web

sites. This trend has had a positive impact on our operating margins, and we expect that this will continue for the

foreseeable future, although the relative rate of growth in revenues from our web sites compared to the rate of

growth in revenues from our Google Network members’ web sites may vary over time.

We continue to invest in building the necessary employee and systems infrastructures required to manage

our growth and develop and promote our products and services, and this may cause our operating margins to

decrease. We have generally experienced and expect to continue to experience growth in our operations as we

build our research and development programs, expand our base of users, advertisers, Google Network members,

and content providers, and increase our presence in international markets. Also, we have acquired and expect to

continue to acquire businesses and other assets from time to time. In particular, we expect to increase the number

of acquisitions we make in 2010 compared to 2009. These acquisitions generally enhance the breadth and depth

of our expertise in engineering and other functional areas, our technologies, and our product offerings. Our full-

time employee headcount was 20,222 at December 31, 2008 and 19,835 at December 31, 2009. In the past few

quarters, we made efforts to improve the discipline of our hiring process and to focus on better managing our

expense growth. However, we expect to continue to invest in our business, including significantly increasing our

hiring rate, and this may cause our operating margins to decrease.

We expect our cost of revenues will increase in dollars and may increase as a percentage of revenues in future

periods, primarily as a result of forecasted increases in traffic acquisition costs, data center costs, and credit card

and other transaction fees, content acquisition costs, and other costs, including the costs of the mobile phones

that we sell. In particular, traffic acquisition costs as a percentage of advertising revenues may increase in the

future if we are unable to continue to improve the monetization or generation of revenues from traffic on our web

sites and our Google Network members’ web sites, including with those members to whom we have guaranteed

minimum revenue share payments.

Our international revenues have grown as a percentage of our total revenues from 51% 2008 to 53% in

2009. This increase in the portion of our revenues derived from international markets results largely from

increased acceptance of our advertising programs, and our continued progress in developing localized versions of

our products in these international markets. The increase in the proportion of international revenues derived from

international markets continues to increase our exposure to fluctuations in foreign currency to U.S. dollar

exchange rates. For example, in 2009, the general strengthening of the U.S. dollar relative to foreign currencies

(primarily the Euro and the British pound) had an unfavorable impact on our revenues. We have a foreign exchange

risk management program that is designed to reduce our exposure to fluctuations in foreign currencies. However,

this program will not fully offset the effect of fluctuations on our revenues and earnings.

Recent Development

In January 2010, we announced our decision to review our business operations in China and that we are

discussing with the Chinese government the basis on which we could operate an unfiltered search engine pursuant

to local law. These discussions may result in our shutting down Google.cn, and potentially our offices in China. The

ultimate outcome, including any related exit costs we might incur, is unknown at this time.

40