Google 2009 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The total grant date fair value of stock options vested during 2007, 2008, and 2009 was $635.1 million,

$692.5 million, and $689.7 million. The aggregate intrinsic value of all options and warrants exercised during

2007, 2008 and 2009 was $1,279.0 million, $503.2 million, and $566.1 million. These amounts do not include the

aggregate sales price of options sold under our TSO program.

During 2009, the number of shares underlying TSOs sold to selected financial institutions under the TSO

program was approximately 1.1 million at a total value of $246.8 million, or an average of $231.36 per share,

including an average premium of $23.39 per share. The premium is calculated as the difference between (a) the

sale price of the TSO and (b) the intrinsic value of the TSO, which we define as the excess, if any, of the price of our

Class A common stock at the time of the sale over the exercise price of the TSO. At December 31 2009, the

number of options eligible for participation under the TSO program was approximately 10 million.

In March 2009, we completed an offer to exchange certain employee stock options issued under our 2004

Stock Plan. Certain previously granted options were exchanged for new options with a lower exercise price granted

on a one-for-one basis. Options for an aggregate of approximately 7.6 million shares of our Class A common stock

were exchanged. Options granted pursuant to the Exchange have an exercise price of $308.57 per share, the

closing price of our Class A common stock as reported by The Nasdaq Global Select Market on March 6, 2009.

Options granted pursuant to the Exchange have a new vesting schedule determined by adding 12 months to each

vesting date under the exchanged options’ original vesting schedule. In addition, new options will vest no sooner

than six months after the date of the Exchange. The Exchange resulted in a modification charge of approximately

$360 million which is being recognized over the vesting periods of the new options. These vesting periods range

from six months to five years. We recorded approximately $103 million of the modification charge in 2009.

As of December 31, 2009, there was $1,088.0 million of unrecognized compensation cost related to

outstanding employee stock options. This amount is expected to be recognized over a weighted-average period of

3.1 years. To the extent the actual forfeiture rate is different from what we have anticipated, stock-based

compensation related to these awards will be different from our expectations.

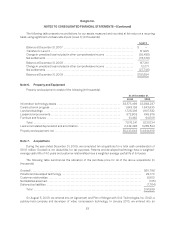

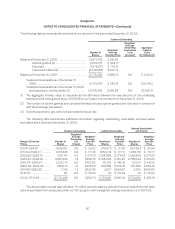

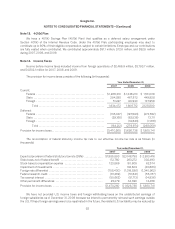

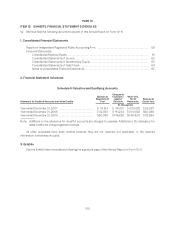

The following table summarizes the activities for our unvested RSUs and restricted shares for the year ended

December 31, 2009:

Unvested Restricted Stock Units

and Restricted Shares

Number of

Shares

Weighted-

Average

Grant-Date

Fair Value

Unvested at December 31, 2008 ............................................... 3,268,089 $ 514.56

Granted ................................................................ 2,991,909 $463.50

Vested ................................................................. (1,290,943) $ 491.13

Canceled ............................................................... (342,568) $464.62

Unvested at December 31, 2009 ............................................... 4,626,487 $492.42

Expected to vest after December 31, 2009 (1) ................................... 4,168,465 $492.42

(1) RSUs and restricted shares expected to vest reflect an estimated forfeiture rate.

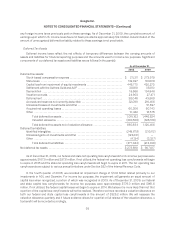

As of December 31, 2009, there was $1,842.7 million of unrecognized compensation cost related to

employee unvested RSUs and restricted shares. This amount is expected to be recognized over a weighted-

average period of 3.0 years. To the extent the actual forfeiture rate is different from what we have anticipated,

stock-based compensation related to these awards will be different from our expectations.

91