Google 2009 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

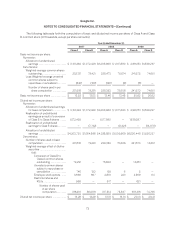

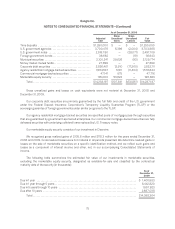

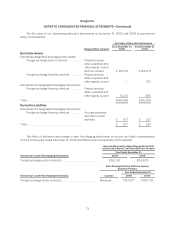

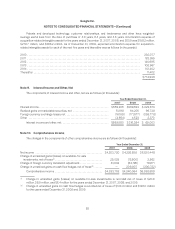

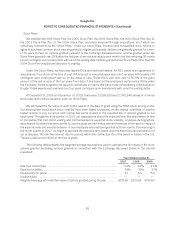

The fair value of our outstanding derivative instruments at December 31, 2008 and 2009 is summarized

below (in thousands):

Fair Value of Derivative Instruments

Balance Sheet Location As of December 31,

2008 As of December 31,

2009

Derivative Assets

Derivatives designated as hedging instruments:

Foreign exchange option contracts .......... Prepaid revenue

share, expenses and

other assets, current

and non-current $ 451,723 $104,278

Foreign exchange forward contracts ......... Prepaid revenue

share, expenses and

other assets, current — 812

Derivatives not designated as hedging instruments:

Foreign exchange forward contracts ......... Prepaid revenue

share, expenses and

other assets, current 13,270 396

Total .......................................... $464,993 $105,486

Derivative Liabilities

Derivatives not designated as hedging instruments:

Foreign exchange forward contracts ......... Accrued expenses

and other current

liabilities $ 877 $ 337

Total .......................................... $ 877 $ 337

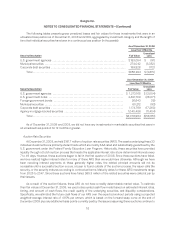

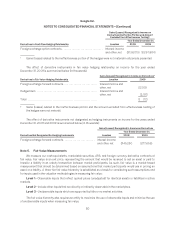

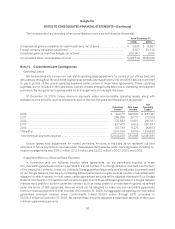

The effect of derivative instruments in cash flow hedging relationship on income and other comprehensive

income for the years ended December 31, 2008 and 2009 is summarized below (in thousands):

Increase (Decrease) in Gains Recognized in AOCI

on Derivative Before Tax Effect (Effective Portion)

Year Ended December 31,

Derivatives in Cash Flow Hedging Relationship 2008 2009

Foreign exchange option contracts ............................ $522,162 $(14,360)

Gains Reclassified from AOCI into Income

(Effective Portion)

Year Ended December 31,

Derivatives in Cash Flow Hedging Relationship Location 2008 2009

Foreign exchange option contracts .......................... Revenues $167,807 $324,705

79