Google 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

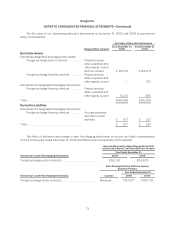

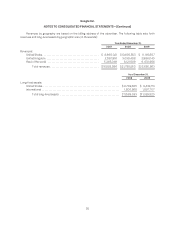

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

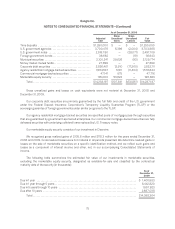

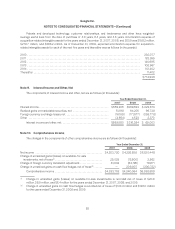

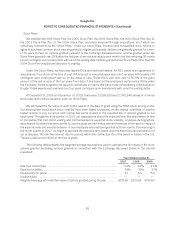

Patents and developed technology, customer relationships, and tradenames and other have weighted-

average useful lives from the date of purchase of 4.0 years, 6.4 years, and 4.6 years. Amortization expense of

acquisition-related intangible assets for the years ended December 31, 2007, 2008, and 2009 was $158.2 million,

$279.7 million, and $266.2 million. As of December 31, 2009, expected amortization expense for acquisition-

related intangible assets for each of the next five years and thereafter was as follows (in thousands):

2010 ...................................................................................... 230,077

2011 ...................................................................................... 182,395

2012 ...................................................................................... 140,695

2013 ...................................................................................... 108,967

2014 ...................................................................................... 101,402

Thereafter ................................................................................. 11,402

$774,938

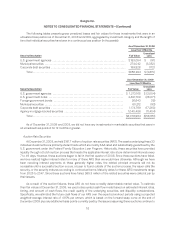

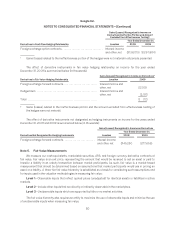

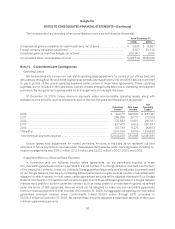

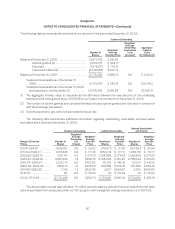

Note 9. Interest Income and Other, Net

The components of interest income and other, net are as follows (in thousands):

Year Ended December 31,

2007 2008 2009

Interest income ..................................................... $559,205 $389,533 $ 229,673

Realized gains on marketable securities, net ........................... 51,198 94,205 96,738

Foreign currency exchange losses, net ................................ (16,169) (171,877) (259,778)

Other ............................................................. (4,654) 4,523 2,370

Interest income and other, net ................................... $589,580 $ 316,384 $ 69,003

Note 10. Comprehensive Income

The changes in the components of other comprehensive income are as follows (in thousands):

Year Ended December 31,

2007 2008 2009

Net income ................................................... $4,203,720 $4,226,858 $6,520,448

Change in unrealized gains (losses) on available-for-sale

investments, net of taxes(1) .................................... 29,029 (12,506) 2,562

Change in foreign currency translation adjustment ................. 61,033 (84,195) 76,671

Change in unrealized gains on cash flow hedges, net of taxes(2) ...... — 209,907 (200,722)

Comprehensive income .................................... $4,293,782 $4,340,064 $6,398,959

(1) Change in unrealized gains (losses) on available-for-sale investments is recorded net of taxes of $20.0

million, $8.9 million, and $6.4 million for the years ended December 31, 2007, 2008, and 2009.

(2) Change in unrealized gains on cash flow hedges is recorded net of taxes of $144.4 million and $138.0 million

for the years ended December 31, 2008 and 2009.

85