Google 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 13. 401(k) Plan

We have a 401(k) Savings Plan (401(k) Plan) that qualifies as a deferred salary arrangement under

Section 401(k) of the Internal Revenue Code. Under the 401(k) Plan, participating employees may elect to

contribute up to 60% of their eligible compensation, subject to certain limitations. Employee and our contributions

are fully vested when contributed. We contributed approximately $51.1 million, $72.6 million, and $82.5 million

during 2007, 2008, and 2009.

Note 14. Income Taxes

Income before income taxes included income from foreign operations of $2,466.9 million, $3,793.7 million,

and $4,802.1 million for 2007, 2008, and 2009.

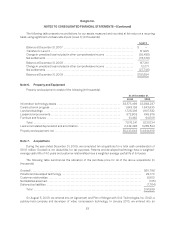

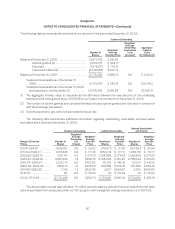

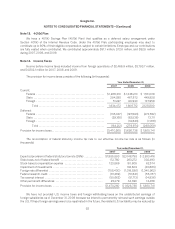

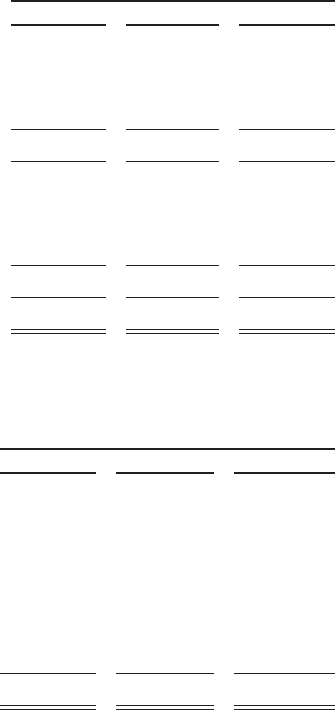

The provision for income taxes consists of the following (in thousands):

Year Ended December 31,

2007 2008 2009

Current:

Federal .................................................... $1,288,310 $ 1,348,210 $ 1,531,016

State ...................................................... 294,935 467,572 449,828

Foreign .................................................... 51,227 90,930 147,956

Total .................................................. 1,634,472 1,906,712 2,128,800

Deferred:

Federal .................................................... (135,047) (197,593) (273,552)

State ...................................................... (29,165) (62,538) 13,111

Foreign .................................................... — (19,843) (7,618)

Total .................................................. (164,212) (279,974) (268,059)

Provision for income taxes ........................................ $1,470,260 $1,626,738 $ 1,860,741

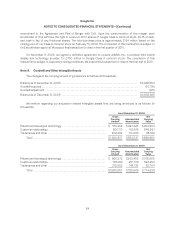

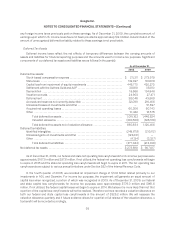

The reconciliation of federal statutory income tax rate to our effective income tax rate is as follows (in

thousands):

Year ended December 31,

2007 2008 2009

Expected provision at federal statutory tax rate (35%) .............. $1,985,893 $2,048,758 $ 2,933,416

State taxes, net of federal benefit ................................ 172,750 263,272 302,493

Stock-based compensation expense ............................. 123,869 90,805 62,574

Impairment of investments ...................................... — 312,603 (40,663)

Foreign rate differential ......................................... (705,400) (1,019,536) (1,340,962)

Federal research credit ......................................... (81,469) (51,841) (55,767)

Tax exempt interest ............................................ (50,662) (51,713) (14,836)

Other permanent differences .................................... 25,279 34,390 14,486

Provision for income taxes ...................................... $1,470,260 $ 1,626,738 $ 1,860,741

We have not provided U.S. income taxes and foreign withholding taxes on the undistributed earnings of

foreign subsidiaries as of December 31, 2009 because we intend to permanently reinvest such earnings outside

the U.S. If these foreign earnings were to be repatriated in the future, the related U.S. tax liability may be reduced by

92