Google 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

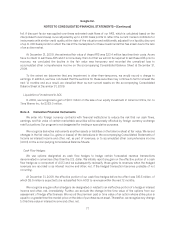

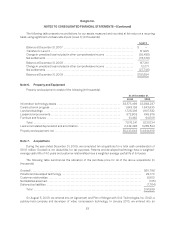

amendment to the Agreement and Plan of Merger with On2. Upon the consummation of the merger, each

stockholder of On2 will have the right to receive 0.0010 shares of Google Class A common stock, $0.15 of cash,

and cash in lieu of any fractional shares. The total purchase price is approximately $124 million based on the

closing price of our Class A common stock on February 10, 2010. The completion of this transaction is subject to

On2 stockholder approval. We expect this transaction to close in the first quarter of 2010.

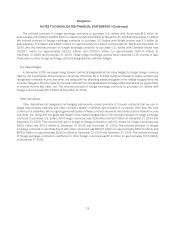

On November 9, 2009, we signed a definitive agreement to acquire AdMob, Inc., a privately-held mobile

display ads technology provider, for $750 million in Google Class A common stock. The completion of this

transaction is subject to customary closing conditions. We expect this transaction to close in the first half of 2010.

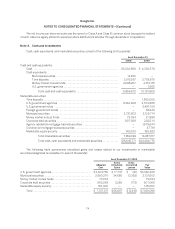

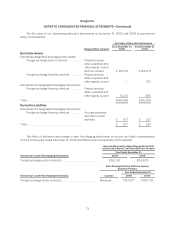

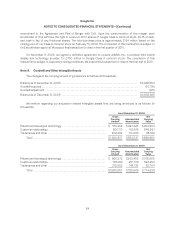

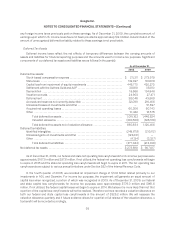

Note 8. Goodwill and Other Intangible Assets

The changes in the carrying amount of goodwill are as follows (in thousands):

Balance as of December 31, 2008 .......................................................... $4,839,854

Goodwill acquired ......................................................................... 60,798

Goodwill adjustment ...................................................................... 1,913

Balance as of December 31, 2009 .......................................................... $4,902,565

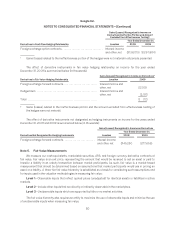

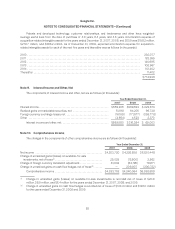

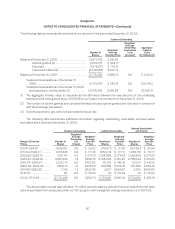

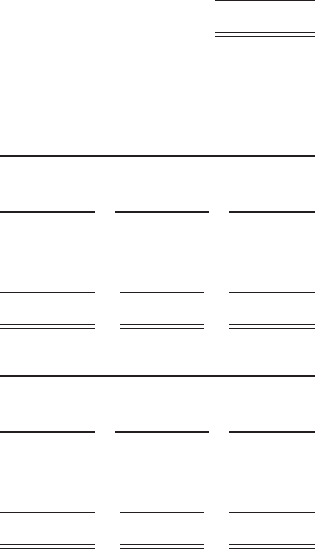

Information regarding our acquisition-related intangible assets that are being amortized is as follows (in

thousands):

As of December 31, 2008

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ................................. $ 551,332 $297,428 $253,904

Customer relationships ............................................ 800,113 153,516 646,597

Tradenames and other ............................................ 209,492 113,303 96,189

Total ....................................................... $1,560,937 $ 564,247 $996,690

As of December 31, 2009

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Value

Patents and developed technology ................................. $ 566,372 $380,492 $ 185,880

Customer relationships ............................................ 783,613 257,319 526,294

Tradenames and other ............................................ 210,902 148,138 62,764

Total ....................................................... $1,560,887 $785,949 $ 774,938

84