Google 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

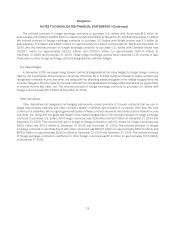

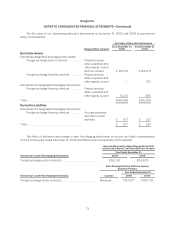

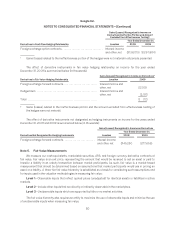

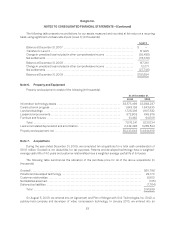

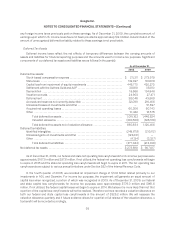

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

continue to increase. Adverse results in these lawsuits, or our decision to license patents based upon these

demands, may result in substantial costs and, in the case of adverse litigation results, could prevent us from

offering certain features, functionalities, products, or services, which could result in a loss of revenue for us or

otherwise harm our business.

We are also a party to other litigation and subject to claims incident to the ordinary course of business,

including intellectual property claims (in addition to the trademark and copyright matters noted above), labor and

employment claims and threatened claims, breach of contract claims, tax, and other matters.

Although the results of litigation and claims cannot be predicted with certainty, we believe that the final

outcome of the matters discussed above will not have a material adverse effect on our business, consolidated

financial position, results of operations, or cash flows.

EPA Investigation

In February 2009, we learned of a U.S. Environmental Protection Agency (EPA) investigation into an alleged

release of refrigerant at one of our smaller data facilities, which we acquired from DoubleClick, and the accuracy of

related statements and records. We are cooperating with the EPA and have provided documents and other

materials. The EPA investigation could result in fines, civil or criminal penalties, or other administrative action.

We currently believe this matter will not have a material adverse effect on our business, consolidated financial

position, results of operations, or cash flows.

Income Taxes

We are currently under audit by the Internal Revenue Service and various other tax authorities. We have

reserved for potential adjustments to our provision for income taxes that may result from examinations by, or any

negotiated agreements with, these tax authorities, and we believe that the final outcome of these examinations or

agreements will not have a material effect on our results of operations. If events occur which indicate payment of

these amounts is unnecessary, the reversal of the liabilities would result in the recognition of tax benefits in the

period we determine the liabilities are no longer necessary. If our estimates of the federal, state, and foreign income

tax liabilities are less than the ultimate assessment, a further charge to expense would result.

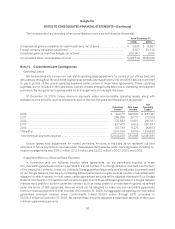

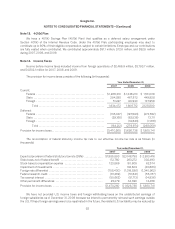

Note 12. Stockholders’ Equity

Convertible Preferred Stock

Our Board of Directors has authorized 100,000,000 shares of convertible preferred stock, $0.001 par value,

issuable in series. At December 31, 2008 and 2009, there were no shares issued or outstanding.

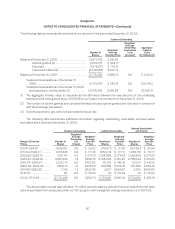

Class A and Class B Common Stock

Our Board of Directors has authorized two classes of common stock, Class A and Class B. At December 31,

2009, there were 6,000,000,000 and 3,000,000,000 shares authorized and there were 243,611,368 and

74,160,683 shares legally outstanding of Class A and Class B common stock. The rights of the holders of Class A

and Class B common stock are identical, except with respect to voting. Each share of Class A common stock is

entitled to one vote per share. Each share of Class B common stock is entitled to 10 votes per share. Shares of

Class B common stock may be converted at any time at the option of the stockholder and automatically convert

upon sale or transfer to Class A common stock. We refer to Class A and Class B common stock as common stock

throughout the notes to these financial statements, unless otherwise noted.

88