Google 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

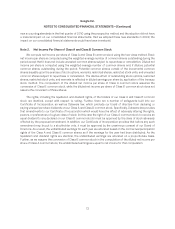

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

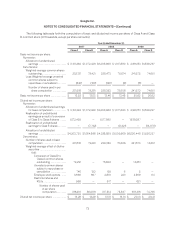

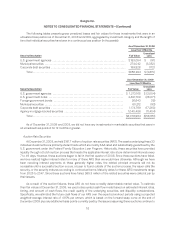

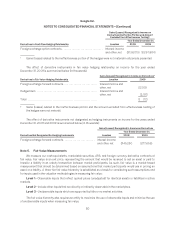

As of December 31, 2009

Adjusted

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses Fair

Value

Time deposits ........................................ $1,250,000 $ — $ — $ 1,250,000

U.S. government agencies ............................. 3,700,476 5,396 (2,004) 3,703,868

U.S. government notes ................................ 2,519,780 — (28,071) 2,491,709

Foreign government bonds ............................. 36,662 — (19) 36,643

Municipal securities ................................... 2,100,241 29,626 (93) 2,129,774

Money market mutual funds ............................ 27,899 — — 27,899

Corporate debt securities .............................. 2,826,461 12,910 (17,260) 2,822,111

Agency residential mortgage-backed securities ........... 1,584,537 5,511 (11,404) 1,578,644

Commercial mortgage-backed securities ................ 47,141 575 — 47,716

Marketable equity security ............................. 145,000 53,823 — 198,823

Total ............................................ $14,238,197 $107,841 $(58,851) $14,287,187

Gross unrealized gains and losses on cash equivalents were not material at December 31, 2008 and

December 31, 2009.

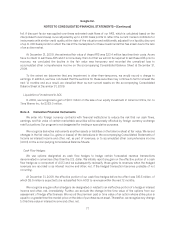

Our corporate debt securities are primarily guaranteed by the full faith and credit of the U.S. government

under the Federal Deposit Insurance Corporation’s Temporary Liquidity Guarantee Program (TLGP) or the

sovereign guarantee of foreign governments under similar programs to the TLGP.

Our agency residential mortgage-backed securities are specified pools of mortgage pass-through securities

that are guaranteed by government-sponsored enterprises. Our commercial mortgage-backed securities are fully

defeased securities with underlying collateral loans replaced by U.S. Treasury notes.

Our marketable equity security consists of our investment in Clearwire.

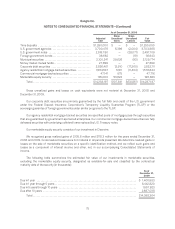

We recognized gross realized gains of $105.8 million and $118.3 million for the years ended December 31,

2008 and 2009. Gross realized losses were not material in all periods presented. We determine realized gains or

losses on the sale of marketable securities on a specific identification method, and we reflect such gains and

losses as a component of interest income and other, net, in our accompanying Consolidated Statements of

Income.

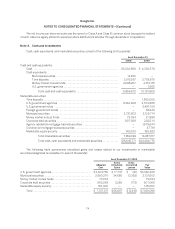

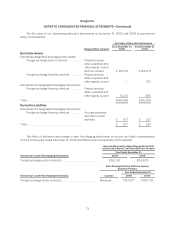

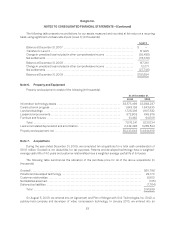

The following table summarizes the estimated fair value of our investments in marketable securities,

excluding the marketable equity security, designated as available-for-sale and classified by the contractual

maturity date of the security (in thousands):

As of

December 31,

2009

Due in 1 year ............................................................................ $ 1,400,583

Due in 1 year through 5 years .............................................................. 8,442,820

Due in 5 years through 10 years ........................................................... 1,557,923

Due after 10 years ....................................................................... 2,687,038

Total ............................................................................... $14,088,364

75