Google 2009 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

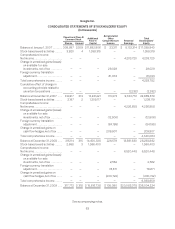

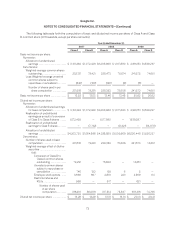

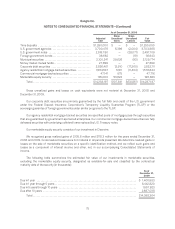

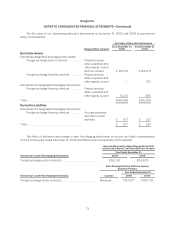

The following table sets forth the computation of basic and diluted net income per share of Class A and Class

B common stock (in thousands, except per share amounts):

Year Ended December 31,

2007 2008 2009

Class A Class B Class A Class B Class A Class B

Basic net income per share:

Numerator:

Allocation of undistributed

earnings ....................... $ 3,131,292 $ 1,072,428 $3,208,968 $ 1,017,890 $ 4,981,151 $1,539,297

Denominator:

Weighted-average common shares

outstanding .................... 232,131 79,421 238,473 75,614 241,575 74,651

Less: Weighted-average unvested

common shares subject to

repurchase or cancellation ....... (616) (130) (120) (8) (5) —

Number of shares used in per

share computation ........... 231,515 79,291 238,353 75,606 241,570 74,651

Basic net income per share ............. $ 13.53 $ 13.53 $ 13.46 $ 13.46 $ 20.62 $ 20.62

Diluted net income per share:

Numerator:

Allocation of undistributed earnings

for basic computation ........... $ 3,131,292 $ 1,072,428 $3,208,968 $ 1,017,890 $ 4,981,151 $1,539,297

Reallocation of undistributed

earnings as a result of conversion

of Class B to Class A shares ..... 1,072,428 — 1,017,890 — 1,539,297 —

Reallocation of undistributed

earnings to Class B shares ....... — (7,732) — (8,321) — (13,070)

Allocation of undistributed

earnings ....................... $4,203,720 $1,064,696 $4,226,858 $1,009,569 $6,520,448 $1,526,227

Denominator:

Number of shares used in basic

computation ................... 231,515 79,291 238,353 75,606 241,570 74,651

Weighted-average effect of dilutive

securities ......................

Add:

Conversion of Class B to

Class A common shares

outstanding ............. 79,291 — 75,606 — 74,651 —

Unvested common shares

subject to repurchase or

cancellation ............. 746 130 128 8 5 —

Employee stock options .... 3,690 667 2,810 223 2,569 114

Restricted shares and

RSUs ................... 968 — 617 — 621 —

Number of shares used

in per share

computation ........ 316,210 80,088 317,514 75,837 319,416 74,765

Diluted net income per share ........... $ 13.29 $ 13.29 $ 13.31 $ 13.31 $ 20.41 $ 20.41

73