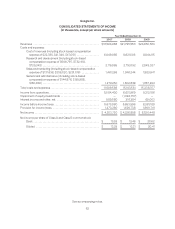

Google 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

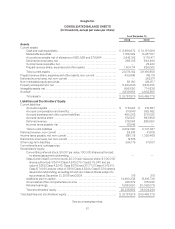

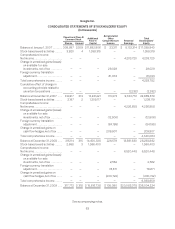

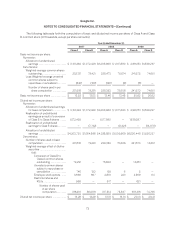

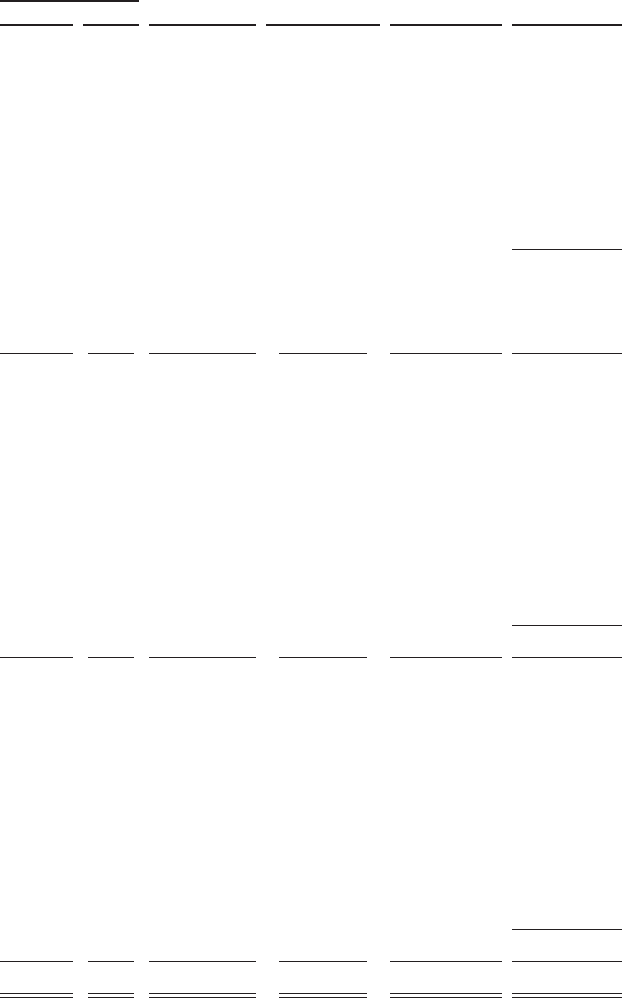

Google Inc.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands)

Class A and Class B

Common Stock Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income Retained

Earnings

Total

Stockholders’

EquityShares Amount

Balance at January 1, 2007 ....... 308,997 $309 $ 11,882,906 $ 23,311 $ 5,133,314 $ 17,039,840

Stock-based award activities ..... 3,920 4 1,358,315 — — 1,358,319

Comprehensive income:

Net income ..................... — — — — 4,203,720 4,203,720

Change in unrealized gains (losses)

on available-for-sale

investments, net of tax ........ — — — 29,029 — 29,029

Foreign currency translation

adjustment ................... — — — 61,033 — 61,033

Total comprehensive income ..... — — — — — 4,293,782

Cumulative effect of change in

accounting principle related to

uncertain tax positions ........ — — — — (2,262) (2,262)

Balance at December 31, 2007 . . . 312,917 313 13,241,221 113,373 9,334,772 22,689,679

Stock-based award activities ..... 2,197 2 1,209,117 — — 1,209,119

Comprehensive income:

Net income ..................... — — — — 4,226,858 4,226,858

Change in unrealized gains (losses)

on available-for-sale

investments, net of tax ........ — — — (12,506) — (12,506)

Foreign currency translation

adjustment ................... — — — (84,195) — (84,195)

Change in unrealized gains on

cash flow hedges, net of tax .... — — — 209,907 — 209,907

Total comprehensive income ..... — — — — — 4,340,064

Balance at December 31, 2008 . . . 315,114 315 14,450,338 226,579 13,561,630 28,238,862

Stock-based award activities ..... 2,658 3 1,366,400 — — 1,366,403

Comprehensive income:

Net income ..................... — — — — 6,520,448 6,520,448

Change in unrealized gains (losses)

on available-for-sale

investments, net of tax ........ — — — 2,562 — 2,562

Foreign currency translation

adjustment ................... — — — 76,671 — 76,671

Change in unrealized gains on

cash flow hedges, net of tax .... — — — (200,722) — (200,722)

Total comprehensive income ..... — — — — — 6,398,959

Balance at December 31, 2009 . . . 317,772 $ 318 $ 15,816,738 $ 105,090 $20,082,078 $36,004,224

See accompanying notes.

63