Google 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

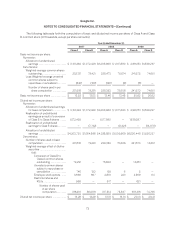

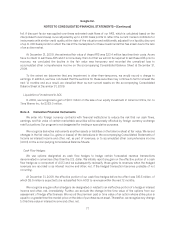

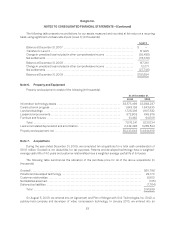

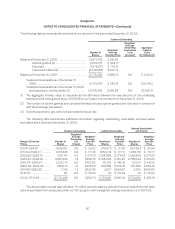

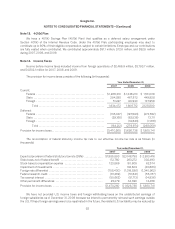

The following table presents reconciliations for our assets measured and recorded at fair value on a recurring

basis, using significant unobservable inputs (Level 3) (in thousands):

Level 3

Balance at December 31, 2007 ..................................................... $ —

Transfers to Level 3 ............................................................... 311,225

Change in unrealized loss included in other comprehensive income ..................... (35,485)

Net settlements ................................................................... (78,379)

Balance at December 31, 2008 ..................................................... 197,361

Change in unrealized loss included in other comprehensive income ..................... 12,071

Net settlements ................................................................... (27,748)

Balance at December 31, 2009 ..................................................... $181,684

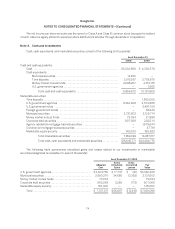

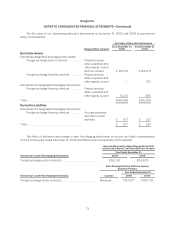

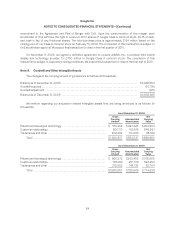

Note 6. Property and Equipment

Property and equipment consist of the following (in thousands):

As of December 31,

2008 2009

Information technology assets ................................................ $3,573,499 $3,868,287

Construction in progress ..................................................... 1,643,136 1,643,630

Land and buildings .......................................................... 1,725,336 1,907,532

Leasehold improvements ..................................................... 572,908 645,876

Furniture and fixtures ........................................................ 61,462 64,809

Total .................................................................. 7,576,341 8,130,134

Less accumulated depreciation and amortization ................................ 2,342,498 3,285,524

Property and equipment, net .................................................. $5,233,843 $ 4,844,610

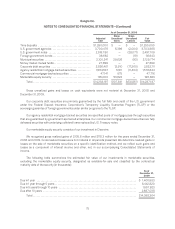

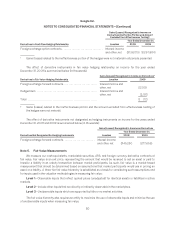

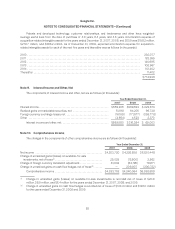

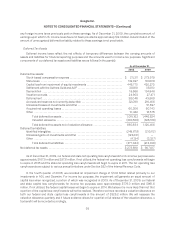

Note 7. Acquisitions

During the year ended December 31, 2009, we completed ten acquisitions for a total cash consideration of

$91.6 million. Goodwill is not deductible for tax purposes. Patents and developed technology have a weighted-

average useful life of 4.0 years and customer relationships have a weighted-average useful life of 6.4 years.

The following table summarizes the allocation of the purchase price for all of the above acquisitions (in

thousands):

Goodwill .................................................................................... $60,798

Patents and developed technology ............................................................. 29,770

Customer relationships ....................................................................... 8,900

Net liabilities assumed ........................................................................ (105)

Deferred tax liabilities ........................................................................ (7,764)

Total .................................................................................. $91,599

On August 5, 2009, we entered into an Agreement and Plan of Merger with On2 Technologies, Inc. (On2), a

publicly-held company and developer of video compression technology. In January 2010, we entered into an

83