Google 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

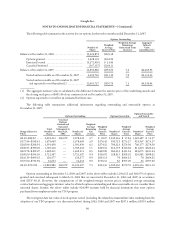

In addition, during the year ended December 31, 2007, we capitalized intangible assets of $5.2 million, paid in cash,

related to patent purchases.

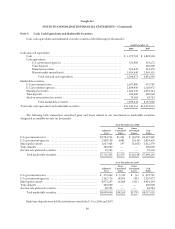

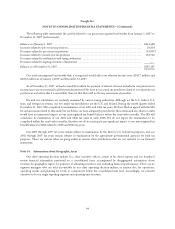

The following table summarizes the allocation of the purchase price for all of the above acquisitions, excluding

Postini (in thousands):

Goodwill .................................................................................. $201,067

Patents and developed technology .............................................................. 81,275

Customer relationships ...................................................................... 13,230

Tradenames and other ....................................................................... 6,200

Net assets acquired .......................................................................... 6,181

Deferred tax liabilities ........................................................................ (25,947)

Purchased in-process research and development .................................................. 4,790

Total ................................................................................. $286,796

Goodwill expected to be deductible for tax purposes is $5.1 million.

Patents and developed technology, customer relationships, and tradenames and other intangible assets have a

weighted-average useful life of 3.7 years, 3.8 years and 3.3 years from the date of acquisition. The amount expected to be

deductible for tax purposes is $7.6 million.

Purchased in-process research and development was expensed at the time of the acquisitions because technological

feasibility had not been established and no future alternative uses existed. This amount was included in research and

development expenses on the accompanying Consolidated Statements of Income.

In connection with certain acquisitions in the current and prior years, we are obligated to make additional cash

payments if certain criteria are met. As of December 31, 2007, our remaining contingent obligations related to these

acquisitions was approximately $800 million. Since these contingent payments are based on the achievement of

performance targets, actual payments may be substantially lower.

Agreement and Plan of Merger with DoubleClick

In April 2007, we entered into an Agreement and Plan of Merger with DoubleClick to acquire all of the outstanding

interests of DoubleClick, a privately held company, for $3.1 billion in cash, plus the cash and cash equivalents of

DoubleClick, plus the aggregate exercise price for outstanding options and stock appreciation rights for DoubleClick

common stock, as well as certain other adjustments, minus certain unpaid third party expenses incurred by DoubleClick in

connection with this transaction and minus all indebtedness for borrowed money of DoubleClick.

In addition, unvested options and stock appreciation rights for DoubleClick common stock will be converted into

options to purchase our common stock with economic terms similar to outstanding vested equity interests.

Although the transaction has been cleared by the Federal Trade Commission in the U.S., the completion of this

transaction is subject to various customary conditions, including receiving antitrust clearance from the European

Commission. We and DoubleClick have each agreed to take all actions necessary to obtain the requisite antitrust and

other regulatory approvals.

84