Google 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

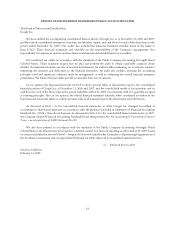

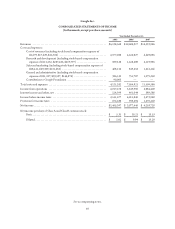

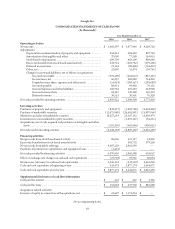

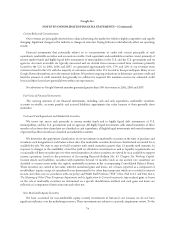

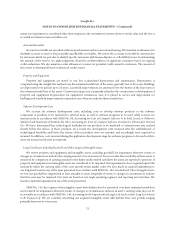

Google Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended December 31,

2005 2006 2007

Operating activities

Net income .................................................. $ 1,465,397 $ 3,077,446 $ 4,203,720

Adjustments:

Depreciation and amortization of property and equipment ....... 256,812 494,430 807,743

Amortization of intangibles and other ........................ 37,000 77,509 159,915

Stock-based compensation ................................. 200,709 458,100 868,646

Excess tax benefits from stock-based award activity .............. 433,724 (581,732) (379,206)

Deferred income taxes ..................................... 21,163 (98,468) (164,212)

Other, net ............................................... 22,040 12,474 (39,741)

Changes in assets and liabilities, net of effects of acquisitions:

Accounts receivable .................................. (372,290) (624,012) (837,247)

Income taxes, net .................................... 66,237 496,882 744,802

Prepaid revenue share, expenses and other assets ........... (51,663) (289,157) (298,689)

Accounts payable .................................... 80,631 95,402 70,135

Accrued expenses and other liabilities .................... 166,764 291,533 418,905

Accrued revenue share ................................ 93,347 139,300 150,310

Deferred revenue .................................... 39,551 30,801 70,329

Net cash provided by operating activities .......................... 2,459,422 3,580,508 5,775,410

Investing activities

Purchases of property and equipment ............................. (838,217) (1,902,798) (2,402,840)

Purchase of marketable securities ................................ (12,675,880) (26,681,891) (15,997,060)

Maturities and sales of marketable securities ....................... 10,257,214 23,107,132 15,659,473

Investments in non-marketable equity securities .................... — (1,019,147) (34,511)

Acquisitions, net of cash acquired and purchases of intangible and other

assets ..................................................... (101,310) (402,446) (906,651)

Net cash used in investing activities .............................. (3,358,193) (6,899,150) (3,681,589)

Financing activities

Net proceeds from stock-based award activity ...................... 85,026 321,117 23,861

Excess tax benefits from stock-based award activity .................. — 581,732 379,206

Net proceeds from public offerings ............................... 4,287,229 2,063,549 —

Payments of principal on capital leases and equipment loans .......... (1,425) — —

Net cash provided by financing activities .......................... 4,370,830 2,966,398 403,067

Effect of exchange rate changes on cash and cash equivalents .......... (21,758) 19,741 40,034

Net increase (decrease) in cash and cash equivalents ................. 3,450,301 (332,503) 2,536,922

Cash and cash equivalents at beginning of year ..................... 426,873 3,877,174 3,544,671

Cash and cash equivalents at end of year ........................... $ 3,877,174 $ 3,544,671 $ 6,081,593

Supplemental disclosures of cash flow information

Cash paid for interest .......................................... $ 216 $ 257 $ 1,336

Cash paid for taxes ............................................ $ 153,628 $ 537,702 $ 882,688

Acquisition related activities:

Issuance of equity in connection with acquisitions, net ............... $ 22,407 $ 1,173,234 $ —

See accompanying notes.

68