Google 2007 Annual Report Download - page 55

Download and view the complete annual report

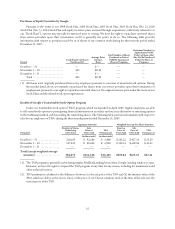

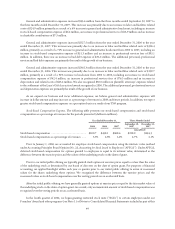

Please find page 55 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Checkout. Further, cash ultimately paid to merchants under Google Checkout promotions, including cash paid to

merchants as a result of discounts provided to consumers on certain transactions processed through Google Checkout, is

accounted for as an offset to revenues.

In the third quarter of 2007, we acquired Postini, a provider of electronic communications security, compliance, and

productivity software. We recognize as revenue the fees we charge customers for hosting enterprise applications and

services ratably over the terms of the service arrangements.

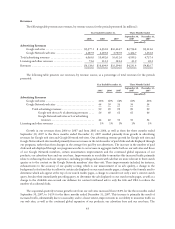

Trends in Our Business

Our business has grown rapidly since inception, resulting in substantially increased revenues, and we expect that our

business will continue to grow. However, our revenue growth rate has generally declined over time, and we expect it will

continue to do so as a result of increasing competition and the difficulty of maintaining growth rates as our revenues

increase to higher levels. In addition, the main focus of our advertising programs is to provide relevant and useful

advertising to our users, reflecting our commitment to constantly improve their overall web experience. As a result, we

may continue to take steps to improve the relevance of the ads displayed on our web sites and our Google Network

members’ web sites. These steps include removing ads that generate low click-through rates or that send users to

irrelevant or otherwise low quality sites and terminating Google Network members whose web sites do not meet our

quality requirements. In addition, we may continue to take steps to reduce the number of accidental clicks. These steps

could negatively affect our near-term advertising revenues. Both seasonal fluctuations in internet usage and traditional

retail seasonality have affected, and are likely to continue to affect, our business. Internet usage generally slows during the

summer months, and commercial queries typically increase significantly in the fourth quarter of each year. These seasonal

trends have caused and will likely continue to cause, fluctuations in our quarterly results, including fluctuations in

sequential revenue and paid click growth rates.

From the inception of the Google Network in 2002 through the first quarter of 2004, the growth in advertising

revenues from our Google Network members’ web sites exceeded that from our web sites, which had a negative impact on

our operating margins. The operating margin we realize on revenues generated from ads placed on our Google Network

members’ web sites through our AdSense program is significantly lower than the operating margin we realize from

revenues generated from ads placed on our web sites because most of the advertiser fees from ads served on Google

Network member web sites are shared with our Google Network members. However, beginning in the second quarter of

2004, growth in advertising revenues from our web sites has exceeded that from our Google Network members’ web sites.

This trend has had a positive impact on our operating margins, and we expect that this will continue for the foreseeable

future, although the relative rate of growth in revenues from our web sites compared to the rate of growth in revenues

from our Google Network members’ web sites may vary over time.

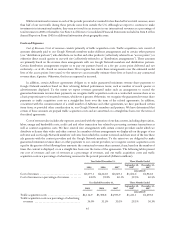

We are heavily investing in building the necessary employee and systems infrastructures required to manage our

growth and develop and promote our products and services, and this may cause our operating margins to decrease. We

have experienced and expect to continue to experience substantial growth in our operations as we build our research and

development programs, expand our base of users, advertisers, Google Network members and content providers and

increase our presence in international markets. Also, we have acquired and expect to continue to acquire businesses and

other assets from time to time. These acquisitions generally enhance the breadth and depth of our expertise in engineering

and other functional areas, our technologies and our product offerings. In addition, we are incurring significant costs and

expenses to support our Google Checkout product and promote its adoption by merchants and consumers, as well as

promote the distribution of certain other products, including the Google Toolbar. Our headcount growth has required us

to make substantial investments in property and equipment. Our full-time employee headcount has significantly increased

over the last 12 months, growing from 10,674 at December 31, 2006 to 16,805 at December 31, 2007, and we also utilize a

significant number of temporary employees. We also expect to continue to make significant capital expenditure

investments, including information and technology infrastructure and corporate facilities. In April 2007, we launched our

employee transferable stock option (TSO) program. We modified employee options to allow them to participate in this

program, and as a result we incurred a modification charge of approximately $95 million in 2007 related to vested options,

and we expect to incur an additional modification charge of approximately $134 million related to unvested options over

41