Google 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Google Inc.

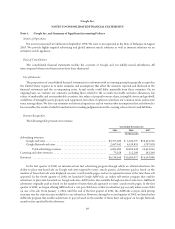

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Income Taxes

We recognize income taxes under the liability method. Deferred income taxes are recognized for differences between

the financial reporting and tax bases of assets and liabilities at enacted statutory tax rates in effect for the years in which

differences are expected to reverse. The effect on deferred taxes of a change in tax rates is recognized in income in the

period that includes the enactment date.

Foreign Currency

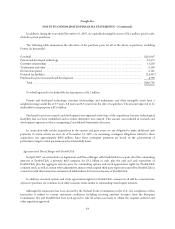

Generally, the functional currency of our international subsidiaries is the local currency. The financial statements of

these subsidiaries are translated to U.S. dollars using month-end rates of exchange for assets and liabilities, and average

rates of exchange for revenues, costs and expenses. Translation gains and losses are recorded in accumulated other

comprehensive income as a component of stockholders’ equity. We recorded $18.0 million of net translation losses, and

$38.6 million and $61.0 million of net translation gains in 2005, 2006 and 2007, respectively. Net gains and losses

resulting from foreign exchange transactions are recorded as interest income and other, net. These gains and losses are net

of those realized on forward foreign exchange contracts. We recorded $6.3 million and $5.3 million of net gains, and $16.2

million of net losses in 2005, 2006 and 2007 from assets and liabilities denominated in a currency other than the local

currency.

Derivative Financial Instruments

We enter into forward foreign exchange contracts with financial institutions to reduce the risk that our cash flows and

earnings will be adversely affected by foreign currency exchange rate fluctuations. This program is not designed for trading

or speculative purposes.

In accordance with SFAS No. 133, Accounting for Derivative Instruments and Hedging Activities, we recognize

derivative instruments as either assets or liabilities on the balance sheet at fair value. These forward exchange contracts are

not accounted for as hedges and, therefore, changes in the fair value of these instruments are recorded as interest income

and other, net. Neither the cost nor the fair value of these forward foreign exchange contracts was material at

December 31, 2007. The notional principal of forward foreign exchange contracts to purchase U.S. dollars with foreign

currencies was $735.7 million and $1,498.6 million at December 31, 2006 and December 31, 2007. The notional principal

of forward foreign exchange contracts to purchase euros with British pounds, Japanese yen, Australian dollars and Swedish

Krona was €296.5 million (or approximately $433.4 million) at December 31, 2007. There were no other forward foreign

exchange contracts outstanding at December 31, 2006 or December 31, 2007.

Legal Costs

Legal costs are expensed as incurred.

Advertising and Promotional Expenses

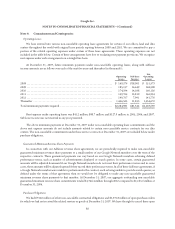

We expense advertising and promotional costs in the period in which they are incurred. For the years ended

December 31, 2005, 2006 and 2007 promotional and advertising expenses totaled approximately $104.3 million, $188.4

million and $236.7 million.

Effect of Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 157, Fair Value

Measurements (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value in generally

accepted accounting principles, and expands disclosures about fair value measurements. SFAS 157 does not require any

76