Google 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

We provide U.S. income taxes on the earnings of foreign subsidiaries unless the subsidiaries’ earnings are considered

permanently reinvested outside the U.S. To the extent that the foreign earnings previously treated as permanently

reinvested are repatriated, the related U.S. tax liability may be reduced by any foreign income taxes paid on these earnings.

As of December 31, 2007, the cumulative amount of earnings upon which U.S. income taxes have not been provided is

approximately $3,900.6 million. Determination of the amount of unrecognized deferred tax liability related to these

earnings is not practicable.

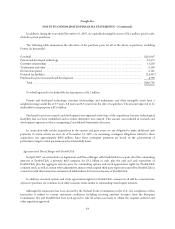

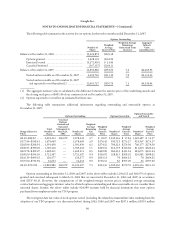

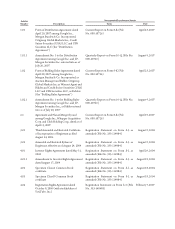

Deferred Tax Assets

Deferred income taxes reflect the net effects of temporary differences between the carrying amounts of assets and

liabilities for financing reporting purposes and the amounts used for income tax purposes. Significant components of our

deferred tax assets and liabilities are as follows (in thousands):

As of December 31,

2006 2007

Deferred tax assets:

Stock-based compensation ................................................... $ 40,772 $ 118,297

State taxes ................................................................. — 86,256

Depreciation ............................................................... 26,009 53,900

Vacation accruals ........................................................... 11,256 18,868

Deferred Rent .............................................................. 9,565 17,498

Accruals and reserves not currently deductible .................................... 6,867 9,824

Unrealized losses on investments and other ...................................... 1,996 —

Other ..................................................................... 4,242 14,674

Total deferred tax assets ................................................. 100,707 319,317

Deferred tax liabilities:

Identified intangibles ........................................................ (107,781) (127,700)

Undistributed earnings of foreign subsidiaries .................................... — (55,329)

Unrealized gains on investments and other ....................................... — (30,187)

Other ..................................................................... (3,634) (4,344)

Total deferred tax liabilities ............................................... (111,415) (217,560)

Net deferred tax assets (liabilities) .................................................. $ (10,708) $ 101,757

As of December 31, 2007, our federal net operating loss carryforwards for income tax purposes were approximately

$22.1 million. If not utilized, the federal net operating loss carryforwards will begin to expire in 2024. The net operating

loss carryforwards are subject to various limitations under Section 382 of the Internal Revenue Code.

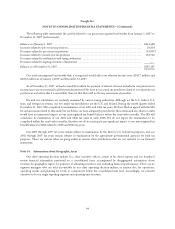

Uncertain Tax Positions

Effective January 1, 2007, we adopted the provisions of FIN 48. This Interpretation clarifies the accounting for

uncertainty in income taxes recognized in an enterprise’s financial statements in accordance with SFAS No. 109 and

prescribes a recognition threshold of more-likely-than-not to be sustained upon examination. Upon adoption of FIN 48,

our policy to include interest and penalties related to gross unrecognized tax benefits within our provision for income

taxes did not change. The adjustment to retained earnings upon adoption to FIN 48 on January 1, 2007 was $2.3 million.

93