Google 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

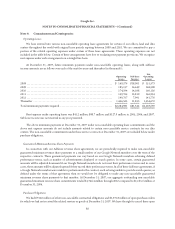

Note 7. Acquisitions

In September 2007, we completed the acquisition of Postini, Inc., a provider of information security and compliance

solutions. This transaction was accounted for as a business combination. The purchase price was $545.7 million, paid in

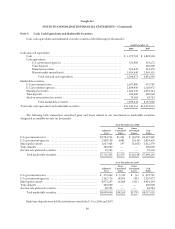

cash, including direct transaction costs of $1.0 million. The following table summarizes the allocation of the purchase

price of Postini (in thousands):

Goodwill .................................................................................. $446,471

Customer relationships ...................................................................... 104,310

Patents and developed technology ............................................................. 35,510

Tradenames and other ....................................................................... 5,630

Net assets acquired ......................................................................... 8,240

Deferred tax liabilities ....................................................................... (54,507)

Total ................................................................................ $545,654

Net assets acquired include involuntary termination benefits of $16.6 million that we expect to pay certain Postini

employees. In addition, we are obligated to make cash payments of up to $44.8 million through 2011, contingent upon

each employee’s continued employment with us. These contingent payments will be expensed, when and if earned.

Goodwill is not deductible for tax purposes.

Customer relationships, patents and developed technology, and tradenames and other intangible assets have

weighted-average useful lives of 6.8 years, 4.0 years and 2.6 years from the date of acquisition. These assets are not

deductible for tax purposes.

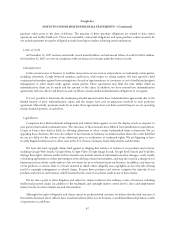

Supplemental information on an unaudited pro forma basis, as if the Postini acquisition had been consummated at

the beginning of each of the periods presented, is as follows (in millions, except per share amounts):

Year Ended December 31,

2005 2006 2007

(unaudited)

Revenues .............................................................. $6,180.5 $10,663.1 $16,651.1

Net income ............................................................ $1,423.0 $ 3,032.0 $ 4,165.5

Net income per share of Class A and Class B common stock—diluted ............. $ 4.88 $ 9.79 $ 13.17

The unaudited pro forma supplemental information is based on estimates and assumptions, which we believe are

reasonable; it is not necessarily indicative of our consolidated financial position or results of income in future periods or

the results that actually would have been realized had we been a combined company during the periods presented. The

unaudited pro forma supplemental information includes incremental intangible asset amortization and other charges as a

result of the acquisition, net of the related tax effects.

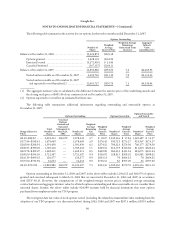

During the year ended December 31, 2007, we also completed seventeen other acquisitions. Three of these

transactions were accounted for as asset purchases in accordance with EITF Issue No. 98-3, Determining Whether a

Nonmonetary Transaction Involves Receipt of Productive Assets or of a Business, as the acquired companies were considered

to be development stage enterprises. The remaining fourteen transactions were accounted for as business combinations.

The total initial purchase price for these transactions was $281.6 million and was paid or will be paid in cash. In addition,

we are obligated to make additional cash payments of up to $72.4 million if certain performance targets are met through

2010. Since these contingent payments are based on the achievement of performance targets, actual payments may be

substantially lower. A portion of these contingent payments will be accounted for as goodwill, and the remaining amounts

will be expensed, when and if earned.

83