Google 2007 Annual Report Download - page 73

Download and view the complete annual report

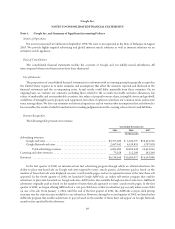

Please find page 73 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our effective tax rates have differed from the statutory rate primarily due to the tax impact of foreign operations,

research and experimentation tax credits, state taxes, and certain benefits realized related to stock option activity. The

effective tax rate was 31.6%, 23.3% and 25.9% for 2005, 2006 and 2007. Our future effective tax rates could be adversely

affected by earnings being lower than anticipated in countries where we have lower statutory rates and higher than

anticipated in countries where we have higher statutory rates, by changes in the valuation of our deferred tax assets or

liabilities, or by changes in tax laws, regulations, accounting principles, or interpretations thereof. In addition, we are

subject to the continuous examination of our income tax returns by the Internal Revenue Service and other tax authorities.

We regularly assess the likelihood of adverse outcomes resulting from these examinations to determine the adequacy of

our provision for income taxes.

Stock-Based Compensation

We account for stock-based compensation in accordance with SFAS 123R. Under the provisions of SFAS 123R,

stock-based compensation cost is estimated at the grant date based on the award’s fair value as calculated by the Black-

Scholes-Merton (“BSM”) option-pricing model and is recognized as expense over the requisite service period. The BSM

model requires various highly judgmental assumptions including volatility, forfeiture rates and expected option life. If any

of the assumptions used in the BSM model change significantly, stock-based compensation expense may differ materially

in the future from that recorded in the current period.

Traffic Acquisition Costs

We are obligated under certain agreements to make non-cancelable guaranteed minimum revenue share payments to

Google Network members based on their achieving defined performance terms, such as number of search queries or

advertisements displayed. To the extent we expect revenues generated under such an arrangement to exceed the

guaranteed minimum revenue share payments, we recognize traffic acquisition costs on a contractual revenue share basis

or on a basis proportionate to forecasted revenues, whichever is greater; if our estimate of revenues under such an

arrangement is subsequently revised downward, then the amount of traffic acquisition costs we would recognize thereafter

would be proportionately greater. Otherwise, we recognize the guaranteed revenue share payments as traffic acquisition

costs on a straight-line basis over the term of the related agreements.

Effect of Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 157, Fair Value

Measurements (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value in generally

accepted accounting principles, and expands disclosures about fair value measurements. SFAS 157 does not require any

new fair value measurements, but provides guidance on how to measure fair value by providing a fair value hierarchy used

to classify the source of the information. SFAS 157 is effective for fiscal years beginning after November 15, 2007.

However, on December 14, 2007, the FASB issued proposed FSP FAS 157-b which would delay the effective date of

SFAS 157 for all nonfinancial assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value

in the financial statements on a recurring basis (at least annually). This proposed FSP partially defers the effective date of

Statement 157 to fiscal years beginning after November 15, 2008, and interim periods within those fiscal years for items

within the scope of this FSP. Effective for 2008, we will adopt SFAS 157 except as it applies to those nonfinancial assets

and nonfinancial liabilities as noted in proposed FSP FAS 157-b. The partial adoption of SFAS 157 will not have a material

impact on our consolidated financial position, results of operations or cash flows.

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial Liabilities-

including an Amendment of FASB Statement No. 115 (“SFAS 159”), which allows an entity to choose to measure certain

financial instruments and liabilities at fair value. Subsequent measurements for the financial instruments and liabilities an

entity elects to fair value will be recognized in earnings. SFAS 159 also establishes additional disclosure requirements.

SFAS 159 is effective for us beginning January 1, 2008. We are currently evaluating the potential impact of the adoption of

SFAS 159 on our consolidated financial position, results of operations or cash flows.

59