Google 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• whether we are able to enter into more AdSense arrangements that provide for lower revenue share obligations

or whether increased competition for arrangements with existing and potential Google Network members

results in less favorable revenue share arrangements.

• whether we are able to continue to improve the monetization of traffic on our web sites and our Google Network

members’ web sites, particularly with those members to whom we have guaranteed minimum revenue share

payments.

• whether we share with existing and new partners proportionately more of the aggregate advertising fees that we

earn from paid clicks derived from search queries these partners direct to our web sites.

• the relative growth rates of expenses associated with distribution arrangements and the related revenues

generated.

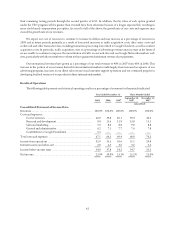

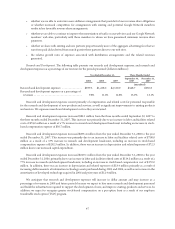

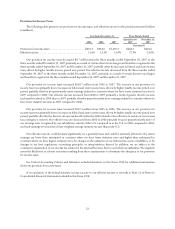

Research and Development. The following table presents our research and development expenses, and research and

development expenses as a percentage of our revenues for the periods presented (dollars in millions):

Year Ended December 31, Three Months Ended

2005 2006 2007 September 30,

2007 December 31,

2007

(unaudited)

Research and development expenses ............... $599.5 $1,228.6 $2,120.0 $548.7 $630.8

Research and development expenses as a percentage of

revenues .................................... 9.8% 11.6% 12.8% 13.0% 13.1%

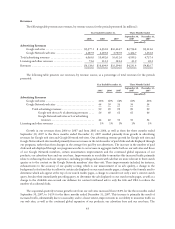

Research and development expenses consist primarily of compensation and related costs for personnel responsible

for the research and development of new products and services, as well as significant improvements to existing products

and services. We expense research and development costs as they are incurred.

Research and development expenses increased $82.1 million from the three months ended September 30, 2007 to

the three months ended December 31, 2007. This increase was primarily due to an increase in labor and facilities related

costs of $74.0 million as a result of a 7% increase in research and development headcount including an increase in stock-

based compensation expense of $30.7 million.

Research and development expenses increased $891.4 million from the year ended December 31, 2006 to the year

ended December 31, 2007. This increase was primarily due to an increase in labor and facilities related costs of $708.0

million as a result of a 57% increase in research and development headcount, including an increase in stock-based

compensation expense of $282.3 million. In addition, there was an increase in depreciation and related expenses of $72.3

million due to our increased capital expenditure.

Research and development expenses increased $629.1 million from the year ended December 31, 2005 to the year

ended December 31, 2006, primarily due to an increase in labor and facilities related costs of $514.5 million as a result of a

77% increase in research and development headcount, including an increase in stock-based compensation cost of $172.0

million. In addition, there was an increase in depreciation and related expenses of $53.4 million primarily as a result of

increasing dollar amounts of information technology assets purchased during 2005 and 2006, as well as an increase in the

amortization of developed technology acquired in 2006 and prior years of $12.4 million.

We anticipate that research and development expenses will increase in dollar amount and may increase as a

percentage of revenues in 2008 and future periods because we expect to hire more research and development personnel

and build the infrastructure required to support the development of new, and improve existing, products and services. In

addition, we expect to recognize greater stock-based compensation on a per option basis as a result of our employee

transferable stock option (TSO) program.

47