Google 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

General and administrative expenses increased $55.6 million from the three months ended September 30, 2007 to

the three months ended December 31, 2007. This increase was primarily due to an increase in labor and facilities related

costs of $24.9 million primarily as a result of a 6% increase in general and administrative headcount, including an increase

in stock-based compensation expense of $6.2 million, an increase in professional services of $15.9 million and an increase

in charitable contributions of $7.3 million.

General and administrative expenses increased $527.5 million from the year ended December 31, 2006 to the year

ended December 31, 2007. This increase was primarily due to an increase in labor and facilities related costs of $306.4

million, primarily as a result of a 72% increase in general and administrative headcount from 2006 to 2007, including an

increase in stock-based compensation expense of $51.3 million and an increase in professional services fees of $95.1

million. In addition, there was an increase in bad debt expense of $35.6 million. The additional personnel, professional

services and bad debt expenses are primarily the result of the growth of our business.

General and administrative expenses increased $365.3 million from the year ended December 31, 2005 to the year

ended December 31, 2006. This increase was primarily due to an increase in labor and facilities related costs of $192.7

million, primarily as a result of a 92% increase in headcount from 2005 to 2006, including an increase in stock-based

compensation expense of $42.4 million, an increase in professional services fees of $76.3 million and an increase in

depreciation and related costs of $43.4 million. We also recognized $30.0 million in plaintiffs’ attorneys’ expenses related

to the settlement of the Lane’s Gift class action lawsuit recognized in 2006. The additional personnel, professional services

and depreciation expenses are primarily the result of the growth of our business.

As we expand our business and incur additional expenses, we believe general and administrative expenses will

increase in dollar amount and may increase as a percentage of revenues in 2008 and future periods. In addition, we expect

greater stock-based compensation expenses on a per option basis as a result of our TSO program.

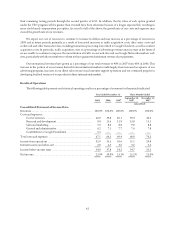

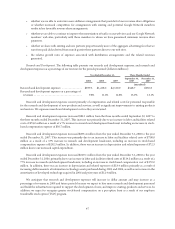

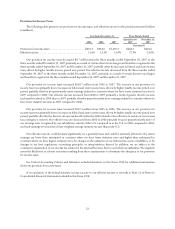

Stock-Based Compensation Expense. The following table presents our stock-based compensation and stock-based

compensation as a percentage of revenues for the periods presented (dollars in millions):

Year Ended December 31, Three Months Ended

2005 2006 2007 September 30,

2007 December 31,

2007

(unaudited)

Stock-based compensation .......................... $200.7 $458.1 $868.6 $198.0 $245.3

Stock-based compensation as a percentage of revenues . . . 3.3% 4.3% 5.2% 4.7% 5.1%

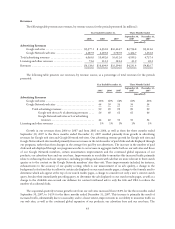

Prior to January 1, 2006, we accounted for employee stock-based compensation using the intrinsic value method

under Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (“APB 25”). Under APB 25,

deferred stock-based compensation for options granted to employees is equal to its intrinsic value, determined as the

difference between the exercise prices and the values of the underlying stock on the dates of grant.

Prior to our initial public offering we typically granted stock options at exercise prices equal to or less than the value

of the underlying stock as determined by our board of directors on the date of option grant. For purposes of financial

accounting, we applied hindsight within each year or quarter prior to our initial public offering to arrive at reassessed

values for the shares underlying these options. We recognized the difference between the exercise prices and the

reassessed values as stock-based compensation over the vesting periods on an accelerated basis.

After the initial public offering, we have generally granted options at exercise prices equal to the fair market value of

the underlying stock on the dates of option grant. As a result, only an immaterial amount of stock-based compensation was

recognized over the vesting periods on an accelerated basis.

In the fourth quarter of 2004, we began granting restricted stock units (“RSUs”) to certain employees under our

Founders’ Award and other programs (see Note 11 of Notes to Consolidated Financial Statements included as part of this

49