Google 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

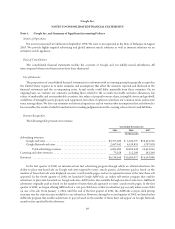

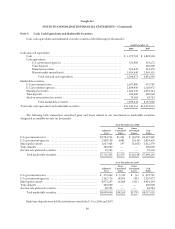

Prior to the adoption of SFAS 123R, we accounted for our employee stock-based compensation using the intrinsic

value method prescribed by APB 25. We applied below the disclosure provisions of SFAS 123, as amended by SFAS

No. 148, as if the fair value method had been applied. If this method had been used, our net income and net income per

share for the years ended December 31, 2005 would have been adjusted to the pro forma amounts below (in thousands,

except per share amounts):

Year Ended

December 31,

2005

Net income, as reported .................................................................... $1,465,397

Add: Stock-based employee compensation expense included in reported net income, net of related tax

effects ................................................................................ 117,924

Deduct: Total stock-based employee compensation expense under the fair value based method for all

awards, net of related tax effects ........................................................... (220,525)

Net income, pro forma ..................................................................... $1,362,796

Net income per share:

As reported for prior period—basic ...................................................... $ 5.31

Pro forma—basic ..................................................................... $ 4.94

As reported for prior period—diluted .................................................... $ 5.02

Pro forma—diluted ................................................................... $ 4.67

For purposes of the above pro forma calculation, the value of each option granted through December 31, 2005 was

estimated on the date of grant using the BSM pricing model with the following weighted-average assumptions.

Year Ended

December 31,

2005

Risk-free interest rate ...................................................................... 3.86%

Expected volatility ........................................................................ 36%

Expected life (in years) ..................................................................... 3.1

Dividend yield ........................................................................... —

Weighted-average estimated fair value of options granted during the year ............................ $78.58

Stock Options Exercised Prior to Vesting

Options granted under plans other than the 2004 Stock Plan may be exercised prior to vesting. Upon the exercise of

an option prior to vesting, the exercising optionee is required to enter into a restricted stock purchase agreement with us,

which provides that we have a right to repurchase the shares purchased upon exercise of the option at the original exercise

price; provided, however, that our right to repurchase these shares will lapse in accordance with the vesting schedule

included in the optionee’s option agreement. In accordance with EITF 00-23, Issues Related to Accounting for Stock

Compensation under APB Opinion No. 25 and FASB Interpretation No. 44 (“EITF 00-23”), stock options granted or

modified after March 21, 2002, which are subsequently exercised for cash prior to vesting are treated differently from prior

grants and related exercises. The consideration received for an exercise of an option granted after the effective date of this

guidance is considered to be a deposit of the exercise price and the related dollar amount is recorded as a liability. The

shares and liability are only reclassified into equity on a ratable basis as the award vests. We have applied this guidance and

recorded a liability on the Consolidated Balance Sheets relating to 1,296,155 and 360,679 of options granted subsequent

to March 21, 2002 that were exercised and are unvested at December 31, 2006 and 2007. Furthermore, these shares are

not presented as outstanding on the accompanying Consolidated Statements of Stockholders’ Equity and Consolidated

Balance Sheets. Instead, these shares are disclosed as outstanding options in Note 11 to these financial statements.

73