Google 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Google Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 4. Non-Marketable Equity Securities

In April 2006, we completed our $1.0 billion cash purchase of a five percent equity interest in a wholly-owned

subsidiary of Time Warner, Inc. that owns all of the outstanding interests of America Online (“AOL”). Our investment in

this non-marketable equity security is accounted for at historical cost (see Note 1). In March 2006, we entered into certain

commercial arrangements with AOL. We believe that the terms of the investment and commercial agreements are at fair

value, and as a result, they are accounted for in accordance with their contractual terms.

Further, we are obligated over a five year term to make up to $100 million of co-marketing payments (but not to

exceed $20 million per year plus any amounts not spent in prior years) and issue up to $300 million of AdWords credits

(but not to exceed $60 million per year plus any credits not redeemed in prior years). Co-marketing costs are expensed as

incurred, and AdWords credits are accounted for as a reduction to revenues in the periods they are redeemed. At

December 31, 2007, our remaining co-marketing and AdWords credits commitments were $79 million and $193 million,

respectively.

We did not experience any material impairment charges on our non-marketable equity securities in the years

presented.

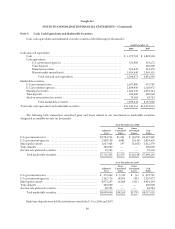

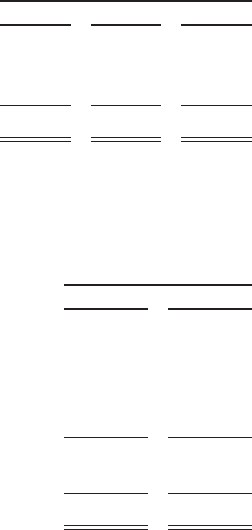

Note 5. Interest Income and Other, Net

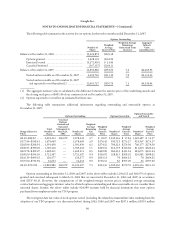

The components of interest income and other, net were as follows (in thousands):

Year Ended December 31,

2005 2006 2007

Interest income ......................................................... $121,038 $412,063 $559,205

Interest expense ........................................................ (776) (257) (1,203)

Other ................................................................. 4,137 49,238 31,578

Interest income and other, net ......................................... $124,399 $461,044 $589,580

Note 6. Property and Equipment

Property and equipment consist of the following (in thousands):

As of December 31,

2006 2007

Information technology assets .................................................... $1,778,028 $2,734,916

Construction in process ......................................................... 850,164 1,364,651

Land and buildings ............................................................. 352,112 951,334

Leasehold improvements ........................................................ 273,262 416,884

Furniture and fixtures ........................................................... 36,028 52,127

Total .................................................................... 3,289,594 5,519,912

Less accumulated depreciation and amortization ..................................... 894,355 1,480,651

Property and equipment, net ..................................................... $2,395,239 $4,039,261

82