Google 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Form 10-K for additional information). Under these programs, the fair values of the underlying stock on the dates of grant

are recognized as stock-based compensation over the four year vesting periods on an accelerated basis. In the second

quarter of 2005, we began granting RSUs to newly hired employees. These RSUs vest from zero to 37.5 percent of the

grant amount at the end of each of the four years from date of hire based on the employee’s performance. We recognized

compensation expense for these RSUs under the variable method based on the fair market value of the underlying shares

at the end of each quarter within the vesting periods.

On January 1, 2006, we adopted Statement of Financial Accounting Standards (“SFAS”) No. 123R (revised 2004),

Share-Based Payments (“SFAS 123R”), using the modified-prospective method. Under this method, we recognize stock-

based compensation over the related service periods for any stock-awards issued after December 31, 2005, as well as for all

stock awards issued prior to January 1, 2006 for which the requisite service has not been provided as of January 1, 2006

because these awards are unvested. Stock-based compensation is measured based on the fair values of all stock awards on

the dates of grant.

We have elected to use the Black-Scholes-Merton (“BSM”) option-pricing model to determine the fair value of

stock-based awards under SFAS 123R, consistent with that used for pro forma disclosures under SFAS No. 123,

Accounting for Stock-Based Compensation.

We continue to recognize stock-based compensation using the accelerated method for all stock awards issued prior

to January 1, 2006, other than RSUs issued to new employees that vest based on the employee’s performance for which we

use the straight-line method. We elected to recognize stock-based compensation using the straight-line method for all

stock awards issued after January 1, 2006.

As noted above, prior to the adoption of SFAS 123R we accounted for RSUs issued to new employees that vest based

on the employee’s performance under the variable method, under which stock-based compensation is measured based on

the fair value of the underlying shares at the end of each quarter within the vesting periods. As noted above, under SFAS

123R stock-based compensation is measured based on the fair values of the underlying shares on the dates of grant for all

such outstanding RSUs. As a result, to the extent the fair value of the underlying shares is greater at the end of each quarter

within the vesting periods compared to the fair values on the dates of grant, then we will recognize less stock-based

compensation than we would have had we continued to use the variable method.

SFAS 123R requires compensation expense to be recognized based on awards ultimately expected to vest. As a

result, forfeitures need to be estimated on the date of grant and revised, if necessary, in subsequent periods if actual

forfeitures differ from those estimates. On January 1, 2006, we began to estimate forfeitures based on our historical

experience to determine stock-based compensation to be recognized. For the periods prior to January 1, 2006, we

accounted for forfeitures as they occurred.

In addition, we continue to account for stock awards issued to non-employees in accordance with the provisions of

SFAS 123R and EITF 96-18 under which we use the BSM method to measure the value of options granted to

non-employees at each vesting date to determine the appropriate charge to stock-based compensation.

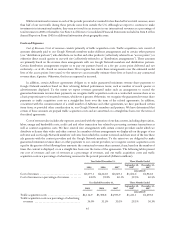

In April 2007, we launched our TSO program. Under the TSO program, certain employees are able to sell vested

options granted after our initial public offering under our 2004 Stock Plan to selected financial institutions in an online

auction. All employees may participate in the program other than our executive management group and those who reside

in countries where, due to local legal or tax implications, it would not be beneficial to employees or the TSO program

would be impractical. At the time of sale, the vested option is automatically amended to create a warrant that is exercisable

by the financial institution within two years from the date of issuance. All eligible outstanding options were modified in

the second quarter of 2007 to allow them to be sold under the TSO program, and, as a result, we incurred a modification

charge of approximately $95 million in 2007 related to vested options as of December 31, 2007, and we expect to incur an

additional modification charge of approximately $134 million related to unvested options over their remaining vesting

periods through the second quarter of 2011. The modification charge is equal to the difference between the values of

those modified stock options on the date of modification and their values immediately prior to modification in accordance

50