Google 2007 Annual Report Download - page 69

Download and view the complete annual report

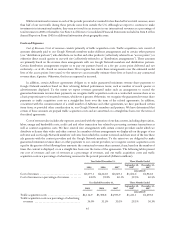

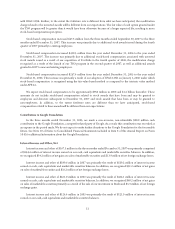

Please find page 69 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.items primarily consisted of $868.6 million of stock-based compensation and $807.7 million of depreciation expense on

property and equipment, partially offset by $379.2 million of excess tax benefits from stock-based award activity (see

discussion below). In addition, changes in working capital activities primarily consisted of a net increase in income taxes

payable and deferred income taxes of $744.8 million (which includes the same $379.2 million of excess tax benefits from

stock-based awards included under adjustments for non-cash items), an increase in accrued expenses and other liabilities

of $418.9 million, an increase in accrued revenue share of $150.3 million, an increase in accounts payable of $70.1 million

and an increase in deferred revenue of $70.3 million. The increases in accounts payable and accrued expenses are a direct

result of the growth of our business and increases in headcount. These increases to working capital activities were partially

offset by an increase of $837.2 million in accounts receivable due to the growth in fees billed to our advertisers and an

increase of $298.7 million in prepaid revenue shares, expenses and other assets.

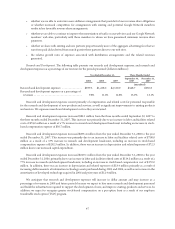

Cash provided by operating activities in 2006 was $3,580.5 million and consisted of net income of $3,077.4 million,

adjustments for non-cash items of $362.3 million and cash provided by working capital and other activities of $140.8

million. Adjustments for non-cash items primarily consisted of $494.4 million of depreciation expense on property and

equipment and $458.1 million of stock-based compensation, partially offset by $581.7 million of excess tax benefits from

stock-based award activity (see discussion below). In addition, working capital activities primarily consisted of an increase

of $624.0 million in accounts receivable due to the growth in fees billed to our advertisers, partially offset by a net increase

in income taxes payable and deferred income taxes of $496.9 million primarily comprised of the same $581.7 million of

excess tax benefits from stock-based award activity included under adjustments for non-cash items, an increase of $386.9

million in accounts payable and accrued expenses due to the increase in purchases of property and equipment and other

general expenditures, as well as a net increase of $149.9 million in prepaid revenue share, expenses and other assets and

accrued revenue share primarily resulted from prepayments associated with AdSense and distribution arrangements.

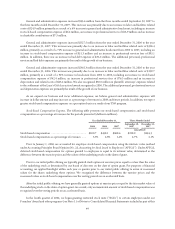

Beginning January 1, 2006, SFAS 123R requires the benefits of tax deductions in excess of the tax-affected

compensation that would have been recognized as if we had always accounted for our stock-based award activity under

SFAS 123R to be reported as a cash flow from financing activities, rather than as a cash flow from operating activities, as

was prescribed under accounting rules applicable through December 31, 2005. In compliance with the modified

prospective transition method under SFAS 123R, these excess tax benefits from stock-based award activity generated in

2006, as well as those previously generated in 2005 under the then applicable accounting rules, are reported as a cash flow

from financing activities and a cash flow from operating activities, respectively. The benefits of tax deductions in excess of

the tax-affected compensation could fluctuate significantly from period to period based on the number of stock-based

awards exercised, sold or vested, the tax benefit realized and the tax-affected compensation recognized.

Cash provided by operating activities in 2005 was $2,459.4 million and consisted of net income of $1,465.4 million,

adjustments for non-cash and other items of $971.4 million and cash provided by working capital and other activities of

$22.6 million. Adjustments for non-cash and other items primarily consisted of $256.8 million of depreciation and

amortization expense on property and equipment and $200.7 million of stock-based compensation, $433.7 million of tax

benefits from stock-based award activity, which represents a portion of the $552.5 million reduction to income taxes

payable that we realized over 2005 related to the exercise, sale or vesting of these awards. Working capital activities

primarily consisted of an increase of $372.3 million in accounts receivable due to growth in fees billed to our advertisers,

an increase of $247.4 million in accounts payable and accrued expenses due to the increase in purchases of property and

equipment, other general expenditures as well as an increase in compensation as a result of the growth in the number of

employees, an increase of $93.3 million in accrued revenue share due to the growth in our AdSense programs and the

timing of payments made to our Google Network members and a net decrease in income taxes receivable and deferred

income taxes of $66.2 million.

As we expand our business internationally, we have offered payment terms to certain advertisers that are standard in

their locales, but longer than terms we would generally offer to our domestic advertisers. This may increase our working

capital requirements and may have a negative effect on cash provided by our operating activities. In addition, since we

have become a public company our cash-based compensation per employee has increased and will likely continue to

increase (primarily in the form of variable bonus awards and other incentive arrangements) in order to retain and attract

employees.

55