Google 2007 Annual Report Download - page 74

Download and view the complete annual report

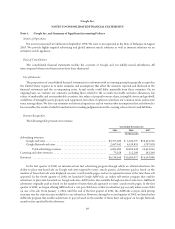

Please find page 74 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2007, the FASB issued SFAS No. 141 (revised 2007), Business Combinations (“SFAS 141R”).

SFAS 141R establishes principles and requirements for how an acquirer recognizes and measures in its financial

statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree and the

goodwill acquired. SFAS 141R also establishes disclosure requirements to enable the evaluation of the nature and financial

effects of the business combination. This statement is effective for us beginning January 1, 2009. We are currently

evaluating the potential impact of the adoption of SFAS 141R on our consolidated financial position, results of operations

or cash flows.

In December 2007, the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial Statements—an

amendment of Accounting Research Bulletin No. 51 (“SFAS 160”). SFAS 160 establishes accounting and reporting standards

for ownership interests in subsidiaries held by parties other than the parent, the amount of consolidated net income

attributable to the parent and to the noncontrolling interest, changes in a parent’s ownership interest, and the valuation of

retained noncontrolling equity investments when a subsidiary is deconsolidated. SFAS 160 also establishes disclosure

requirements that clearly identify and distinguish between the interests of the parent and the interests of the

noncontrolling owners. This statement is effective for us beginning January 1, 2009. We are currently evaluating the

potential impact of the adoption of SFAS 160 on our consolidated financial position, results of operations or cash flows.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

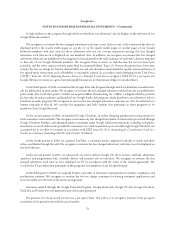

We are exposed to financial market risks, including changes in currency exchange rates and interest rates.

Foreign Exchange Risk

Our exposure to foreign currency transaction gains and losses is the result of certain net receivables due from our

foreign subsidiaries and customers being denominated in currencies other than the U.S. dollar, primarily the British

pound, the euro, the Canadian dollar and the Japanese yen. Our foreign subsidiaries conduct their businesses in local

currency. Our board of directors approved a foreign exchange hedging program designed to minimize the future potential

impact due to changes in foreign currency exchange rates. The program allows for the hedging of transaction exposures.

The types of derivatives that can be used under the policy are forward contracts, options and foreign exchange swaps. We

also generate revenue in certain countries in Asia where there are limited forward currency exchange markets, thus making

these exposures difficult to hedge. We have entered into forward foreign exchange contracts to offset the foreign exchange

risk on certain intercompany assets, as well as cash denominated in currencies other than the local currency of the

subsidiary. The notional principal of forward foreign exchange contracts to purchase U.S. dollars with euros and Taiwan

dollars was $1,498.6 million at December 31, 2007. The notional principal of forward foreign exchange contracts to

purchase euros with British pounds, Japanese yen, Australian dollars and Swedish krona was €296.5 million (or

approximately $433.4 million) at December 31, 2007. There were no other forward exchange contracts outstanding at

December 31, 2007.

Our exposure to foreign currency translation gains and losses arises from the translation of the assets and liabilities of

our subsidiaries to U.S. dollars during consolidation. We recognized translation gains of $61.0 million in 2007 primarily as

a result of generally strengthening foreign currencies against the U.S. dollar and the net asset position of most of our

subsidiaries.

We considered the historical trends in currency exchange rates and determined that it was reasonably possible that

adverse changes in exchange rates of 10% for all currencies could be experienced in the near term. These changes would

have resulted in an adverse impact on income before taxes of approximately $11.6 million and $39.7 million at

December 31, 2006 and December 31, 2007. The adverse impact at December 31, 2006 and 2007 is after consideration of

the offsetting effect of approximately $113.6 million and $163.7 million from forward exchange contracts in place for the

months of December 2006 and December 2007. These reasonably possible adverse changes in exchange rates of 10%

were applied to total monetary assets denominated in currencies other than the local currencies at the balance sheet dates

to compute the adverse impact these changes would have had on our income before taxes in the near term.

60