Google 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

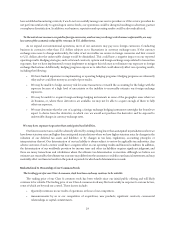

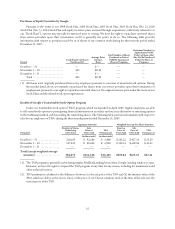

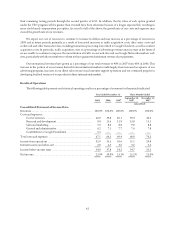

Purchases of Equity Securities by Google

Pursuant to the terms of our 1998 Stock Plan, 2000 Stock Plan, 2003 Stock Plan, 2003 Stock Plan (No. 2), 2003

Stock Plan (No. 3), 2004 Stock Plan and equity incentive plans assumed through acquisitions (collectively referred to as

our “Stock Plans”), options may typically be exercised prior to vesting. We have the right to repurchase unvested shares

from service providers upon their termination, and it is generally our policy to do so. The following table provides

information with respect to purchases made by us of shares of our common stock during the three-month period ended

December 31, 2007:

Period Total Number of Shares

Purchased (1)

Average Price

Paid per

Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

Maximum Number (or

Approximate Dollar

Value) of Shares that

May Yet Be Purchased

Under the Plans or

Programs

October 1 – 31 ................... — $— — —

November 1 – 30 ................. 401 $0.30 — —

December 1 – 31 ................. — $— — —

Total ...................... 401 $0.30 — —

(1) All shares were originally purchased from us by employees pursuant to exercises of unvested stock options. During

the months listed above, we routinely repurchased the shares from our service providers upon their termination of

employment pursuant to our right to repurchase unvested shares at the original exercise price under the terms of our

Stock Plans and the related stock option agreements.

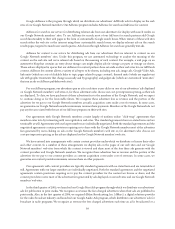

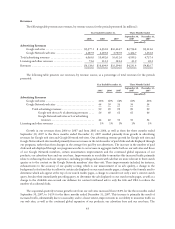

Results of Google’s Transferable Stock Option Program

Under our transferable stock option (TSO) program, which we launched in April 2007, eligible employees are able

to sell vested stock options to participating financial institutions in an online auction as an alternative to exercising options

in the traditional method and then selling the underlying shares. The following table provides information with respect to

sales by our employees of TSOs during the three-month period ended December 31, 2007:

Aggregate Amounts Weighted-Average Per Share Amounts

Period (1)

Number of Shares

Underlying

TSOs Sold

Sale

Price of

TSOs Sold TSO

Premium (2)

Exercise

Price of

TSOs Sold

Sale

Price of

TSOs Sold TSO

Premium (2)

(in thousands) (in thousands)

October 1 – 31 ................ 216,659 $ 92,586 $ 5,480 $ 262.22 $ 427.33 $ 25.29

November 1 – 30 .............. 167,813 $ 68,642 $ 6,982 $ 330.54 $ 409.04 $ 41.61

December 1 – 31 .............. — — — — — —

Total (except weighted-average

amounts) .................. 384,472 $161,228 $12,462 $292.04 $419.35 $32.41

(1) The TSO program is generally active during regular NASDAQ trading hours when Google’s trading window is open.

However, we have the right to suspend the TSO program at any time for any reason, including for maintenance and

other technical reasons.

(2) TSO premium is calculated as the difference between (a) the sale price of the TSO and (b) the intrinsic value of the

TSO, which we define as the excess, if any, of the price of our Class A common stock at the time of the sale over the

exercise price of the TSO.

35