Google 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

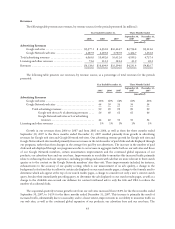

Quarterly Results of Operations

You should read the following tables presenting our quarterly results of operations in conjunction with the

consolidated financial statements and related notes contained elsewhere in this Form 10-K. We have prepared the

unaudited information on the same basis as our audited consolidated financial statements. You should also keep in mind,

as you read the following tables, that our operating results for any quarter are not necessarily indicative of results for any

future quarters or for a full year.

The following table presents our unaudited quarterly results of operations for the eight quarters ended December

2007. This table includes all adjustments, consisting only of normal recurring adjustments, that we consider necessary for

fair presentation of our financial position and operating results for the quarters presented. Both seasonal fluctuations in

internet usage and traditional retail seasonality have affected, and are likely to continue to affect, our business. Internet

usage generally slows during the summer months, and commercial queries typically increase significantly in the fourth

quarter of each year. These seasonal trends have caused and will likely continue to cause, fluctuations in our quarterly

results, including fluctuations in sequential revenue growth rates.

Quarter Ended

Mar 31,

2006 Jun 30,

2006 Sep 30,

2006 Dec 31,

2006 Mar 31,

2007 Jun 30,

2007 Sep 30,

2007 Dec 31,

2007

(in thousands, except per share amounts)

(unaudited)

Consolidated

Statements of

Income Data:

Revenues ........... $2,253,755 $2,455,991 $2,689,673 $3,205,498 $3,663,971 $3,871,985 $4,231,351 $4,826,679

Costs and expenses:

Cost of

revenues ..... 904,119 989,032 1,048,728 1,283,148 1,470,426 1,560,255 1,662,579 1,955,825

Research and

development . 246,599 282,552 312,632 386,806 408,384 532,106 548,712 630,783

Sales and

marketing .... 190,943 196,397 206,972 255,206 302,552 355,604 380,820 422,291

General and

administrative 169,395 172,638 190,010 219,744 261,400 319,405 321,398 377,046

Total costs and

expenses ......... 1,511,056 1,640,619 1,758,342 2,144,904 2,442,762 2,767,370 2,913,509 3,385,945

Income from

operations ........ 742,699 815,372 931,331 1,060,594 1,221,209 1,104,615 1,317,842 1,440,734

Interest income and

other, net ........ 67,919 160,805 108,180 124,139 130,728 137,130 154,428 167,294

Income before income

taxes ............ 810,618 976,177 1,039,511 1,184,733 1,351,937 1,241,745 1,472,270 1,608,028

Provision for income

taxes (1) ......... 218,327 255,100 306,150 154,017 349,775 316,625 402,281 401,579

Net income ......... $ 592,291 $ 721,077 $ 733,361 $1,030,716 $1,002,162 $ 925,120 $1,069,989 $1,206,449

Net income per share

of Class A and

Class B common

stock:

Basic .......... $ 2.02 $ 2.39 $ 2.42 $ 3.36 $ 3.24 $ 2.98 $ 3.44 $ 3.86

Diluted ........ $ 1.95 $ 2.33 $ 2.36 $ 3.29 $ 3.18 $ 2.93 $ 3.38 $ 3.79

53