Google 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

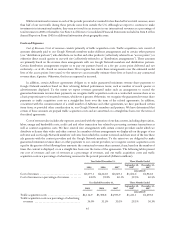

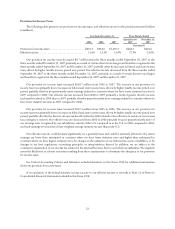

The following table presents our unaudited quarterly results of operations as a percentage of revenues for the eight

quarters ended December 31, 2007 (unaudited).

Quarter Ended

Mar 31,

2006 Jun 30,

2006 Sep 30,

2006 Dec 31,

2006 Mar 31,

2007 Jun 30,

2007 Sep 30,

2007 Dec 31,

2007

As Percentage of Revenues:

Revenues .................................. 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0%

Costs and expenses:

Cost of revenues ............................ 40.1 40.3 39.0 40.0 40.1 40.3 39.3 40.5

Research and development .................... 10.9 11.5 11.6 12.1 11.1 13.7 13.0 13.1

Sales and marketing .......................... 8.5 8.0 7.7 8.0 8.3 9.2 9.0 8.8

General and administrative .................... 7.5 7.0 7.1 6.8 7.2 8.2 7.6 7.8

Total costs and expenses ...................... 67.0 66.8 65.4 66.9 66.7 71.4 68.9 70.2

Income from operations ...................... 33.0 33.2 34.6 33.1 33.3 28.6 31.1 29.8

Interest income and other, net ................. 3.0 6.6 4.0 3.9 3.6 3.5 3.6 3.5

Income before income taxes ................... 36.0 39.8 38.6 37.0 36.9 32.1 34.7 33.3

Net income ................................ 26.3% 29.4% 27.3% 32.2% 27.4% 23.9% 25.2% 25.0%

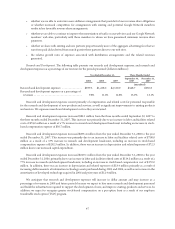

Liquidity and Capital Resources

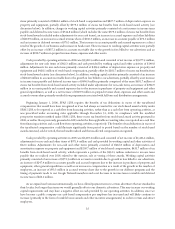

In summary, our cash flows were:

Year Ended December 31,

2005 2006 2007

(in millions)

Net cash provided by operating activities ................................... $ 2,459.4 $ 3,580.5 $ 5,775.4

Net cash used in investing activities ........................................ (3,358.2) (6,899.2) (3,681.6)

Net cash provided by financing activities .................................... 4,370.8 2,966.4 403.1

As a result of our initial public offering in August 2004 and our follow-on public stock offerings in September 2005

and April 2006, we raised approximately $7.5 billion of net proceeds. At December 31, 2007, we had $14.2 billion of cash,

cash equivalents and marketable securities. Cash equivalents and marketable securities are comprised of highly liquid debt

instruments of the U.S. government and its agencies, municipalities in the U.S., time deposits as well as U.S. corporate

securities. Note 3 of Notes to Consolidated Financial Statements included in Item 8 of this Annual Report on Form 10-K

describes further the composition of our cash, cash equivalents and marketable securities.

Our principal sources of liquidity are our cash, cash equivalents and marketable securities, as well as the cash flow

that we generate from our operations. At December 31, 2007 and December 31, 2006, we had unused letters of credit for

approximately $20.4 million and $17.7 million. We believe that our existing cash, cash equivalents, marketable securities

and cash generated from operations will be sufficient to satisfy our currently anticipated cash requirements through at

least the next 12 months. Our liquidity could be negatively affected by a decrease in demand for our products and services.

In addition, we may make acquisitions or license products and technologies complementary to our business and may need

to raise additional capital through future debt or equity financing to provide for greater flexibility to fund any such

acquisitions and licensing activities. Additional financing may not be available at all or on terms favorable to us.

Cash provided by operating activities consisted of net income adjusted for certain non-cash items, including

depreciation, amortization, stock-based compensation expense, excess tax benefits from stock-based award activity and

deferred income taxes, and the effect of changes in working capital and other activities. Cash provided by operating

activities in 2007 was $5,775.4 million and consisted of net income of $4,203.7 million, adjustments for non-cash items of

$1,253.1 million and cash provided by working capital and other activities of $318.6 million. Adjustments for non-cash

54