Google 2007 Annual Report Download - page 65

Download and view the complete annual report

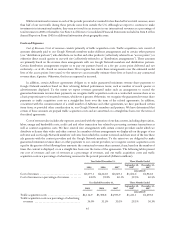

Please find page 65 of the 2007 Google annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.with SFAS 123R. Further, to the extent the forfeiture rate is different from what we have anticipated, the modification

charge related to the unvested awards will be different from our expectations. The fair value of each option granted under

the TSO program will be greater than it would have been otherwise because of a longer expected life, resulting in more

stock-based compensation per option.

Stock-based compensation increased $47.3 million from the three months ended September 30, 2007 to the three

months ended December 31, 2007. This increase was primarily due to additional stock awards issued during the fourth

quarter of 2007 primarily to existing employees.

Stock-based compensation increased $410.5 million from the year ended December 31, 2006 to the year ended

December 31, 2007. The increase was primarily due to additional stock-based compensation associated with unvested

stock awards issued as a result of our acquisition of YouTube in the fourth quarter of 2006, the modification charge

recognized as a result of the launch of our TSO program in the second quarter of 2007, as well as additional awards

granted in 2007 to new and existing employees.

Stock-based compensation increased $257.4 million from the year ended December 31, 2005 to the year ended

December 31, 2006. This increase was primarily a result of our adoption of SFAS 123R on January 1, 2006 under which

stock-based compensation is recognized using the fair-value-based method as compared to the intrinsic value method

under APB 25.

We expect stock-based compensation to be approximately $950 million in 2008 and $1.5 billion thereafter. These

amounts do not include stock-based compensation related to stock awards that have been and may be granted to

employees and directors subsequent to December 31, 2007 and stock awards that have been or may be granted to

non-employees. In addition, to the extent forfeiture rates are different than we have anticipated, stock-based

compensation related to these awards will be different from our expectations.

Contribution to Google Foundation

In the three months ended December 31, 2005, we made a non-recourse, non-refundable $90.0 million cash

contribution to the Google Foundation, a nonprofit related party of Google. As a result, this contribution was recorded as

an expense in the period made. We do not expect to make further donations to the Google Foundation for the foreseeable

future. See Note 10 of Notes to Consolidated Financial Statements included in Item 8 of this Annual Report on Form

10-K for additional information about the Google Foundation.

Interest Income and Other, Net

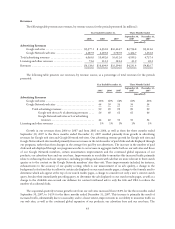

Interest income and other of $167.3 million in the three months ended December 31, 2007 was primarily comprised

of $144.6 million of interest income earned on our cash, cash equivalents and marketable securities balances. In addition,

we recognized $34.2 million of net gains on sales of marketable securities and $13.9 million of net foreign exchange losses.

Interest income and other of $589.6 million in 2007 was primarily the result of $559.2 million of interest income

earned on cash, cash equivalents and marketable securities balances. In addition, we recognized $51.2 million of net gains

on sales of marketable securities and $16.2 million of net foreign exchange losses.

Interest income and other of $461.0 million in 2006 was primarily the result of $412.1 million of interest income

earned on cash, cash equivalents and marketable securities balances. In addition, we recognized $40.2 million of net gains

on sales of marketable securities primarily as a result of the sale of our investment in Baidu and $5.3 million of net foreign

exchange gains.

Interest income and other of $124.4 million in 2005 was primarily the result of $121.0 million of interest income

earned on our cash, cash equivalents and marketable securities balances.

51