Frontier Communications 2005 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-41

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

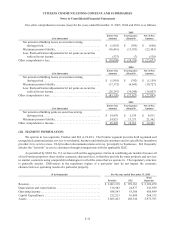

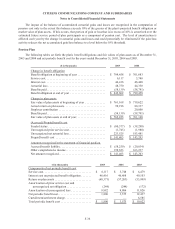

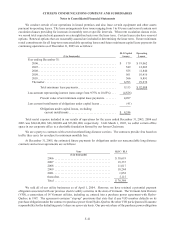

We conduct certain of our operations in leased premises and also lease certain equipment and other assets

pursuant to operating leases. The lease arrangements have terms ranging from 1 to 99 years and several contain rent

escalation clauses providing for increases in monthly rent at specific intervals. When rent escalation clauses exist,

we record total expected rent payments on a straight-line basis over the lease term. Certain leases also have renewal

options. Renewal options that are reasonably assured are included in determining the lease term. Future minimum

rental commitments for all long-term noncancelable operating leases and future minimum capital lease payments for

continuing operations as of December 31, 2005 are as follows:

($ in thousands)

ELI Capital

Leases

Operating

Leases

Year ending December 31:

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 179 $ 19,062

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 549 12,605

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 555 11,840

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 561 10,416

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 566 8,891

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,703 29,274

Total minimum lease payments . . . . . . . . . . . . . . . . . . . . . . . . . . 9,113 $ 92,088

Less amount representing interest (rates range from 9.75% to 10.65%) . . . (4,826)

Present value of net minimum capital lease payments . . . . . . . . 4,287

Less current installments of obligations under capital leases . . . . . . . . . . . (41)

Obligations under capital leases, excluding

current installments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,246

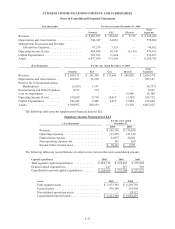

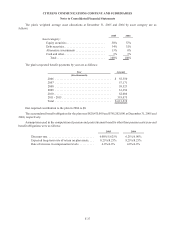

Total rental expense included in our results of operations for the years ended December 31, 2005, 2004 and

2003 was $24,146,000, $26,349,000 and $33,801,000, respectively. Until March 1, 2005, we sublet certain office

space in our corporate office to a charitable foundation formed by our former Chairman.

We are a party to contracts with several unrelated long distance carriers. The contracts provide fees based on

traffic they carry for us subject to minimum monthly fees.

At December 31, 2005, the estimated future payments for obligations under our noncancelable long distance

contracts and service agreements are as follows:

Year ILEC / ELI

($ in thousands)

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 30,619

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,337

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,017

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,244

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,052

thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,115

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 76,384

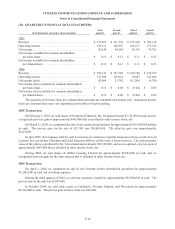

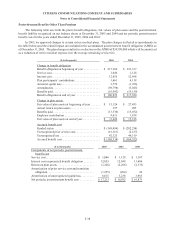

We sold all of our utility businesses as of April 1, 2004. However, we have retained a potential payment

obligation associated with our previous electric utility activities in the state of Vermont. The Vermont Joint Owners

(VJO), a consortium of 14 Vermont utilities, including us, entered into a purchase power agreement with Hydro-

Quebec in 1987. The agreement contains “step-up” provisions that state that if any VJO member defaults on its

purchase obligation under the contract to purchase power from Hydro-Quebec the other VJO participants will assume

responsibility for the defaulting party’s share on a pro-rata basis. Our pro-rata share of the purchase power obligation