Frontier Communications 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-15

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

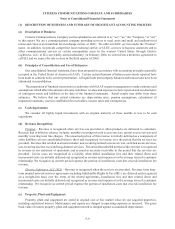

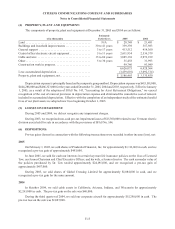

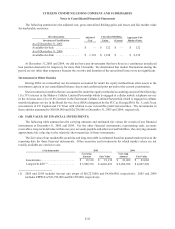

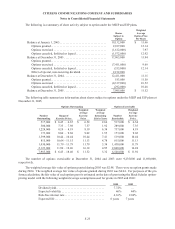

(4) PROPERTY, PLANT AND EQUIPMENT:

The components of property, plant and equipment at December 31, 2005 and 2004 are as follows:

($ in thousands)

Estimated

Useful Lives 2005 2004

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . N/A $ 20,748 $ 21,481

Buildings and leasehold improvements . . . . . . . . . . . . . . . . . 30 to 41 years 359,339 357,983

General support . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 to 17 years 413,512 414,360

Central office/electronic circuit equipment . . . . . . . . . . . . . . 5 to 11 years 2,611,934 2,536,579

Cable and wire . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 to 60 years 3,085,338 2,972,919

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 to 30 years 35,458 31,993

Construction work in progress . . . . . . . . . . . . . . . . . . . . . . . . 99,746 93,049

6,626,075 6,428,364

Less: accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . (3,439,610 ) (3,092,514 )

Property, plant and equipment, net . . . . . . . . . . . . . . . . . . . . . $ 3,186,465 $ 3,335,850

Depreciation expense is principally based on the composite group method. Depreciation expense was $415,581,000,

$444,288,000 and $466,323,000 for the years ended December 31, 2005, 2004 and 2003, respectively. Effective January

1, 2003, as a result of the adoption of SFAS No. 143, “Accounting for Asset Retirement Obligations,” we ceased

recognition of the cost of removal provision in depreciation expense and eliminated the cumulative cost of removal

included in accumulated depreciation. Effective with the completion of an independent study of the estimated useful

lives of our plant assets we adopted new lives beginning October 1, 2005.

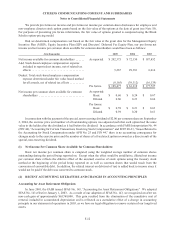

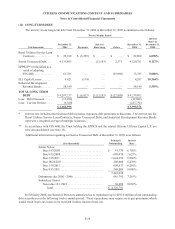

(5) LOSSES ON IMPAIRMENT:

During 2005 and 2004, we did not recognize any impairment charges.

During 2003, we recognized non-cash pre-tax impairment losses of $15,300,000 related to our Vermont electric

division assets held for sale in accordance with the provisions of SFAS No. 144.

(6) DISPOSITIONS:

Pre-tax gains (losses) in connection with the following transactions were recorded in other income (loss), net:

2005

On February 1, 2005, we sold shares of Prudential Financial, Inc. for approximately $1,112,000 in cash, and we

recognized a pre-tax gain of approximately $493,000.

In June 2005, we sold for cash our interests in certain key man life insurance policies on the lives of Leonard

Tow, our former Chairman and Chief Executive Officer, and his wife, a former director. The cash surrender value of

the policies purchased by Dr. Tow totaled approximately $24,195,000, and we recognized a pre-tax gain of

approximately $457,000.

During 2005, we sold shares of Global Crossing Limited for approximately $1,084,000 in cash, and we

recognized a pre-tax gain for the same amount.

2004

In October 2004, we sold cable assets in California, Arizona, Indiana, and Wisconsin for approximately

$2,263,000 in cash. The pre-tax gain on the sale was $40,000.

During the third quarter of 2004, we sold our corporate aircraft for approximately $15,298,000 in cash. The

pre-tax loss on the sale was $1,087,000.