Frontier Communications 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-7

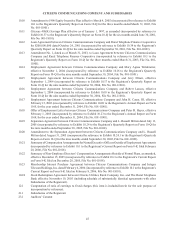

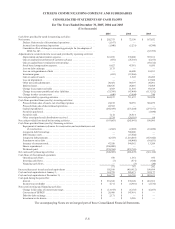

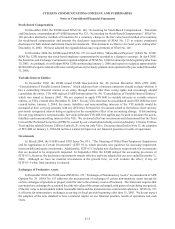

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

For The Years Ended December 31, 2005, 2004 and 2003

($ in thousands, except for per-share amounts)

Additional

Paid-In

Capital

Retained

Earnings

(Deficit)

Accumulated

Other

Comprehensive

Income (Loss)

Total

Shareholders’

Equity

Common Stock Treasury Stock

Shares Amount Shares Amount

Balance December 31, 2002 . 294,080 $ 73,520 $ 1,943,406 $ (553,033) $ (102,169) (11,598) $ (189,585) $ 1,172,139

Stock plans . . . . . . . . . . . . . . 1,354 338 9,911 — — 873 14,450 24,699

Net income . . . . . . . . . . . . . . — — — 187,852 — — — 187,852

Other comprehensive

income, net of tax and

reclassifications

adjustments . . . . . . . . . . — — — — 30,493 — — 30,493

Balance December 31, 2003 . 295,434 73,858 1,953,317 (365,181) (71,676) (10,725) (175,135) 1,415,183

Stock plans . . . . . . . . . . . . . . 4,821 1,206 14,236 — — 6,407 106,823 122,265

Conversion of EPPICS . . . . . 10,897 2,724 133,621 — — 725 11,646 147,991

Conversion of Equity Units . 28,483 7,121 396,221 — — 3,591 56,658 460,000

Dividends on common stock

of $2.50 per share . . . . . — — (832,768) — — — — (832,768)

Net income . . . . . . . . . . . . . . — — — 72,150 — — — 72,150

Tax benefit on equity

forward contracts . . . . . — — — 5,312 — — — 5,312

Other comprehensive loss,

net of tax and

reclassifications

adjustments . . . . . . . . . . — — — — (27,893) — — (27,893)

Balance December 31, 2004 . 339,635 84,909 1,664,627 (287,719) (99,569) (2) (8) 1,362,240

Stock plans . . . . . . . . . . . . . . 2,096 524 24,039 — — 2,598 34,689 59,252

Conversion of EPPICS . . . . . 2,225 556 24,308 — — 391 5,115 29,979

Dividends on common stock

of $1.00 per share . . . . . — — (338,364) — — — — (338,364)

Shares repurchased. . . . . . . . — — — — — (18,775) (250,000) (250,000)

Net income . . . . . . . . . . . . . . — — — 202,375 — — — 202,375

Other comprehensive loss,

net of tax and

reclassifications

adjustments . . . . . . . . . . — — — — (23,673) — — (23,673)

Balance December 31, 2005 . 343,956 $ 85,989 $ 1,374,610 $ (85,344) $ (123,242) (15,788) $ (210,204) $ 1,041,809

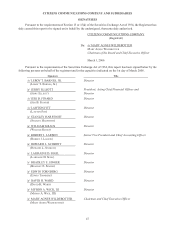

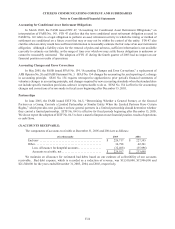

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

For The Years Ended December 31, 2005, 2004 and 2003

($ in thousands, except for per-share amounts)

2005 2004 2003

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 202,375 $ 72,150 $ 187,852

Other comprehensive income (loss), net of tax

and reclassifications adjustments* . . . . . . . . . . . . . . . . . . . . . . . (23,673 ) (27,893 ) 30,493

Total comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 178,702 $ 44,257 $ 218,345

* Consists of unrealized holding (losses)/gains of marketable securities, realized gains taken to income as a result

of the sale of securities and minimum pension liability (see Note 21).

The accompanying Notes are an integral part of these Consolidated Financial Statements.