Frontier Communications 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-18

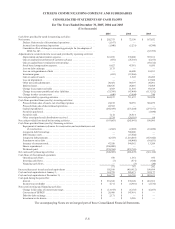

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

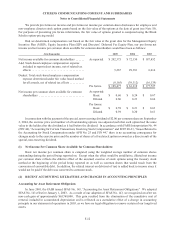

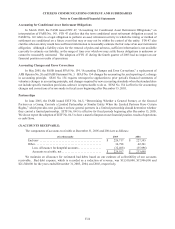

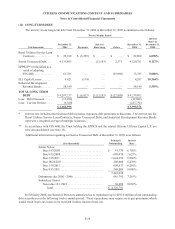

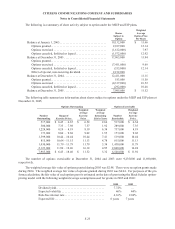

The following summarizes the adjusted cost, gross unrealized holding gains and losses and fair market value

for marketable securities:

($ in thousands) Adjusted

Cost

Unrealized Holding Aggregate Fair

Market Value Investment Classification Gains (Losses)

As of December 31, 2005

Available-for-Sale . . . . . . . . . . . . . . . . $ — $ 122 $ — $ 122

As of December 31, 2004

Available-for-Sale . . . . . . . . . . . . . . . . $ 1,138 $ 1,198 $ — $ 2,336

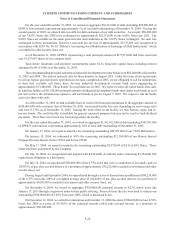

At December 31, 2005 and 2004, we did not have any investments that have been in a continuous unrealized

loss position deemed to be temporary for more than 12 months. We determined that market fluctuations during the

period are not other than temporary because the severity and duration of the unrealized losses were not significant.

Investments in Other Entities

During 2004, we reclassified our investments accounted for under the equity method from other assets to the

investment caption in our consolidated balance sheets and conformed prior periods to the current presentation.

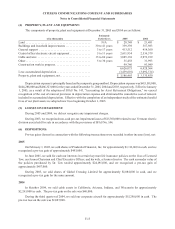

Our investments in entities that are accounted for under the equity method of accounting consist of the following:

(1) a 33% interest in the Mohave Cellular Limited Partnership which is engaged in cellular mobile telephone service

in the Arizona area; (2) a 16.8% interest in the Fairmount Cellular Limited Partnership which is engaged in cellular

mobile telephone service in the Rural Service Area (RSA) designated by the FCC as Georgia RSA No. 3; and (3) our

investments in CU Capital and CU Trust with relation to our convertible preferred securities. The investments in

these entities amounted to $19,014,000 and $20,726,000 at December 31, 2005 and 2004, respectively.

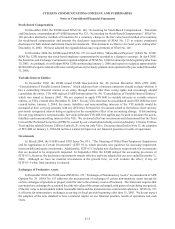

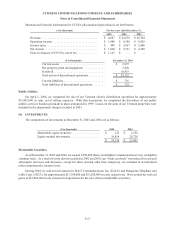

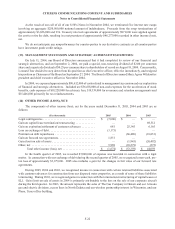

(10) FAIR VALUE OF FINANCIAL INSTRUMENTS:

The following table summarizes the carrying amounts and estimated fair values for certain of our financial

instruments at December 31, 2005 and 2004. For the other financial instruments, representing cash, accounts

receivables, long-term debt due within one year, accounts payable and other accrued liabilities, the carrying amounts

approximate fair value due to the relatively short maturities of those instruments.

The fair value of our marketable securities and long-term debt is estimated based on quoted market prices at the

reporting date for those financial instruments. Other securities and investments for which market values are not

readily available are carried at cost.

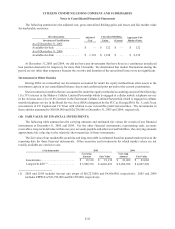

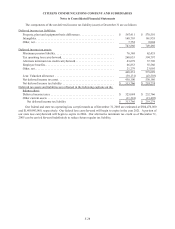

($ in thousands) 2005 2004

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Investments . . . . . . . . . . . . . . . . . . . . . . . $ 19,136 $ 19,136 $ 23,062 $ 23,062

Long-term debt (1) . . . . . . . . . . . . . . . . . . $ 3,999,376 $ 4,026,453 $ 4,266,998 $ 4,607,298

(1) 2005 and 2004 includes interest rate swaps of $(8,727,000) and $4,466,000, respectively. 2005 and 2004

includes EPPICS of $33,785,000 and $63,765,000, respectively.