Frontier Communications 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-22

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

As the result of our call of all of our 8.50% Notes in November 2004, we terminated five interest rate swaps

involving an aggregate $250,000,000 notional amount of indebtedness. Proceeds from the swap terminations of

approximately $3,026,000 and U.S. Treasury rate lock agreements of approximately $971,000 were applied against

the cost to retire the debt, resulting in a net premium of approximately $46,277,000 recorded in other income (loss),

net.

We do not anticipate any nonperformance by counter-parties to our derivative contracts as all counter-parties

have investment grade credit ratings.

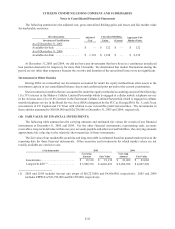

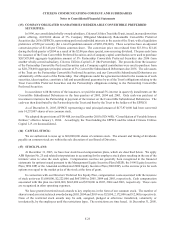

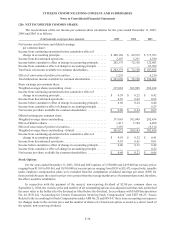

(13) MANAGEMENT SUCCESSION AND STRATEGIC ALTERNATIVES EXPENSES:

On July 11, 2004, our Board of Directors announced that it had completed its review of our financial and

strategic alternatives, and on September 2, 2004, we paid a special, non-recurring dividend of $2.00 per common

share and a quarterly dividend of $0.25 per common share to shareholders of record on August 18, 2004. Concurrently,

Leonard Tow decided to step down from his position as chief executive officer, effective immediately, and resigned

his position as Chairman of the Board on September 27, 2004. The Board of Directors named Mary Agnes Wilderotter

president and chief executive officer in November 2004.

In 2004, we expensed approximately $90,632,000 of costs related to management succession and our exploration

of financial and strategic alternatives. Included are $36,618,000 of non-cash expenses for the acceleration of stock

benefits, cash expenses of $19,229,000 for advisory fees, $19,339,000 for severance and retention arrangements and

$15,446,000 primarily for tax reimbursements.

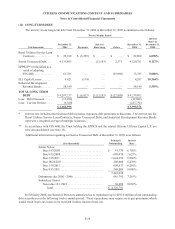

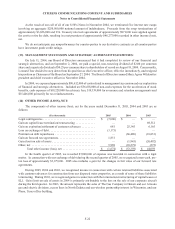

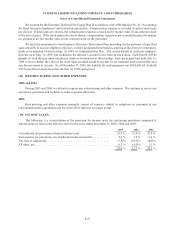

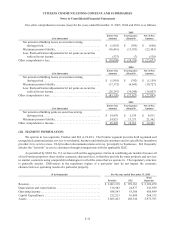

(14) OTHER INCOME (LOSS), NET:

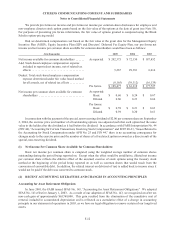

The components of other income (loss), net for the years ended December 31, 2005, 2004 and 2003 are as

follows:

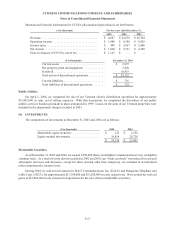

($ in thousands) 2005 2004 2003

Legal contingencies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (7,000 ) $ — $ —

Gain on capital lease termination/restructuring . . . . . . . . . . . . . — — 69,512

Gain on expiration/settlement of customer advances . . . . . . . . . 681 25,345 6,165

Loss on exchange of debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,175 ) — —

Premium on debt repurchases . . . . . . . . . . . . . . . . . . . . . . . . . . . — (66,480 ) (10,851 )

Gain on forward rate agreements . . . . . . . . . . . . . . . . . . . . . . . . . 1,851 — —

Gain (loss) on sale of assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — (1,945 ) (20,492 )

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,969 (10,279 ) (275)

Total other income (loss), net . . . . . . . . . . . . . . . . . . . . . . $ (1,674 ) $ (53,359 ) $ 44,059

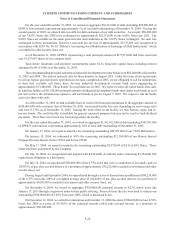

In the fourth quarter of 2005, we recorded $7,000,000 of expense was recorded in connection with a legal

matter. In connection with our exchange of debt during the second quarter of 2005, we recognized a non-cash, pre-

tax loss of approximately $3,175,000. 2005 also includes a gain for the changes in fair value of our forward rate

agreements.

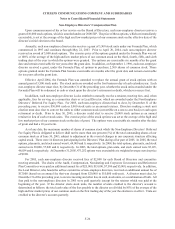

During 2005, 2004 and 2003, we recognized income in connection with certain retained liabilities associated

with customer advances for construction from our disposed water properties, as a result of some of these liabilities

terminating. During 2003, we recognized gains in connection with the termination/restructuring of capital leases at

ELI. Gain (loss) on sale of assets in 2004 is primarily attributable to the loss on the sale of our corporate aircraft

during the third quarter. In 2003, the amount represents the sales of The Gas Company in Hawaii and our Arizona

gas and electric divisions, access lines in North Dakota and our wireless partnership interest in Wisconsin, and our

Plano, Texas office building.