Frontier Communications 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F-20

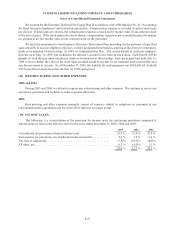

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

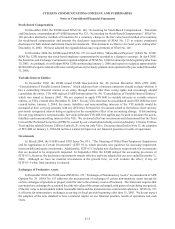

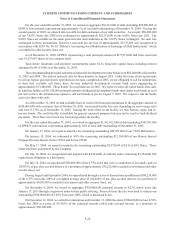

For the year ended December 31, 2005, we retired an aggregate $36,412,000 of debt (including $29,980,000 of

EPPICS conversions), representing approximately 1% of total debt outstanding at December 31, 2004. During the

second quarter of 2005, we entered into two debt-for-debt exchanges of our debt securities. As a result, $50,000,000

of our 7.625% Notes due 2008 were exchanged for approximately $52,171,000 of our 9.00% Notes due 2031. The

9.00% Notes are callable on the same general terms and conditions as the 7.625% Notes exchanged. No cash was

exchanged in these transactions, however a non-cash pre-tax loss of approximately $3,175,000 was recognized in

accordance with EITF No. 96-19, “Debtor’s Accounting for a Modification or Exchange of Debt Instruments” which

is included in other income (loss), net.

As of December 31, 2005, EPPICS representing a total principal amount of $177,971,000 had been converted

into 14,237,807 shares of our common stock.

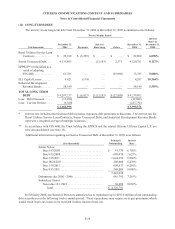

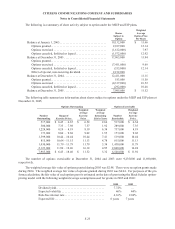

Total future minimum cash payment commitments under ELI’s long-term capital leases including interest

amounted to $9,113,000 as of December 31, 2005.

The total outstanding principal amounts of industrial development revenue bonds were $58,140,000 at December

31, 2005 and 2004. The earliest maturity date for these bonds is in August 2015. Under the terms of our agreements

to sell our former gas and electric operations in Arizona, completed in 2003, we are obligated to call for redemption,

at their first available call dates, three Arizona industrial development revenue bond series aggregating to

approximately $33,440,000. These bonds’ first call dates are in 2007. We expect to retire all called bonds with cash.

In addition, holders of $11,150,000 principal amount of industrial development bonds may tender such bonds to us at

par and we have the simultaneous option to call such bonds at par on August 7, 2007. We expect to call the bonds

and retire them with cash.

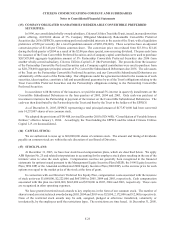

As of December 31, 2005 we had available lines of credit with financial institutions in the aggregate amount of

$250,000,000 with a maturity date of October 29, 2009. Associated facility fees vary depending on our leverage ratio

and were 0.375% as of December 31, 2005. During the term of the credit facility we may borrow, repay and re-

borrow funds. The credit facility is available for general corporate purposes but may not be used to fund dividend

payments. There have never been any borrowings under the facility.

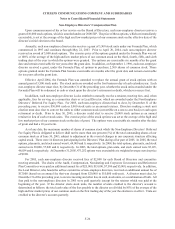

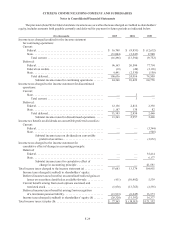

For the year ended December 31, 2004, we retired an aggregate $1,362,012,000 of debt (including $147,991,000

of EPPICS conversions), representing approximately 28% of total debt outstanding at December 31, 2003.

On January 15, 2004, we repaid at maturity the remaining outstanding $80,955,000 of our 7.45% Debentures.

On January 15, 2004, we redeemed at 101% the remaining outstanding $12,300,000 of our Hawaii Special

Purpose Revenue Bonds, Series 1993A and Series 1993B.

On May 17, 2004, we repaid at maturity the remaining outstanding $5,975,000 of ELI’s 6.05% Notes. These

Notes had been guaranteed by the Company.

On July 15, 2004, we renegotiated and prepaid with $4,954,000 of cash the entire remaining $5,524,000 ELI

capital lease obligation to a third party.

On July 30, 2004, we purchased $300,000,000 of the 6.75% notes that were a component of our equity units at

105.075% of par, plus accrued interest, at a premium of approximately $15,225,000 recorded in investment and other

income (loss), net.

During August and September 2004, we repurchased through a series of transactions an additional $108,230,000

of the 6.75% notes due 2006 at a weighted average price of 104.486% of par, plus accrued interest, at a premium of

approximately $4,855,000 recorded in investment and other income (loss), net.

On November 8, 2004, we issued an aggregate $700,000,000 principal amount of 6.25% senior notes due

January 15, 2013 through a registered underwritten public offering. Proceeds from the sale were used to redeem our

outstanding $700,000,000 of 8.50% Notes due 2006, which is discussed below.

On November 12, 2004, we called for redemption on December 13, 2004 the entire $700,000,000 of our 8.50%

Notes due 2006 at a price of 107.182% of the principal amount called, plus accrued interest, at a premium of

approximately $50,300,000.