Frontier Communications 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-34

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

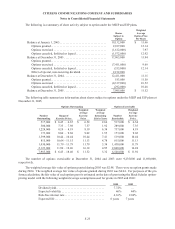

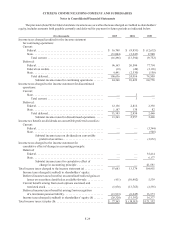

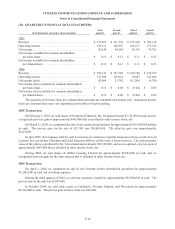

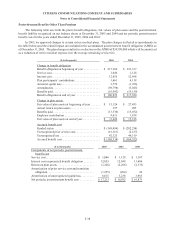

(23) QUARTERLY FINANCIAL DATA (UNAUDITED):

($ in thousands, except per share amounts)

First

quarter

Second

quarter

Third

quarter

Fourth

quarter

2005

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 537,223 $ 531,798 $ 537,346 $ 556,112

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 145,112 146,897 141,617 173,223

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,634 44,584 38,376 76,781

Net income available for common shareholders

per basic share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.13 $ 0.13 $ 0.11 $ 0.23

Net income available for common shareholders

per diluted share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.12 $ 0.13 $ 0.11 $ 0.23

2004

Revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 552,311 $ 537,796 $ 539,188 $ 539,127

Operating income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137,598 126,014 70,087 142,406

Net income (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,868 23,792 (11,290) 16,780

Net income (loss) available for common shareholders

per basic share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.15 $ 0.08 $ (0.04) $ 0.05

Net income (loss) available for common shareholders

per diluted share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 0.15 $ 0.08 $ (0.04) $ 0.05

The quarterly net income (loss) per common share amounts are rounded to the nearest cent. Annual net income

(loss) per common share may vary depending on the effect of such rounding.

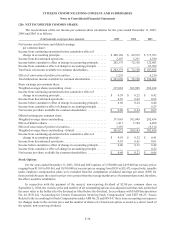

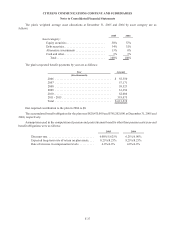

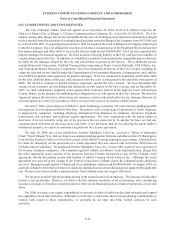

2005 Transactions

On February 1, 2005, we sold shares of Prudential Financial, Inc. for approximately $1,112,000 in cash, and we

recognized a pre-tax gain of approximately $493,000 that is included in other income (loss), net.

On March 15, 2005, we completed the sale of our conferencing business for approximately $43,565,000 million

in cash. The pre-tax gain on the sale of CCUSA was $14,061,000. The after-tax gain was approximately

$1,167,000.

In June 2005, the Company sold for cash its interests in certain key man life insurance policies on the lives of

Leonard Tow, our former Chairman and Chief Executive Officer, and his wife, a former director. The cash surrender

value of the policies purchased by Dr. Tow totaled approximately $24,195,000, and we recognized a pre-tax gain of

approximately $457,000 that is included in other income (loss), net.

During 2005, we sold shares of Global Crossing Limited for approximately $1,084,000 in cash, and we

recognized a pre-tax gain for the same amount that is included in other income (loss), net.

2004 Transactions

On April 1, 2004, we completed the sale of our Vermont electric distribution operations for approximately

$13,992,000 in cash, net of selling expenses.

During the third quarter of 2004, we sold our corporate aircraft for approximately $15,298,000 in cash. The

pre-tax loss on the sale was $1,087,000.

In October 2004, we sold cable assets in California, Arizona, Indiana, and Wisconsin for approximately

$2,263,000 in cash. The pre-tax gain on these sales was $40,000.