Frontier Communications 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

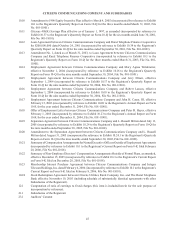

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

During the third and fourth quarters of 2003, we recognized additional pre-tax impairment losses of $4.0

million and $11.3 million related to our Vermont property to write down assets to be sold to our best estimate of their

net realizable value upon sale.

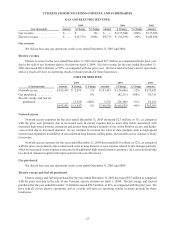

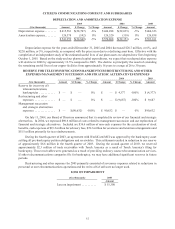

INVESTMENT AND OTHER INCOME (LOSS), NET / INTEREST EXPENSE /

INCOME TAX EXPENSE (BENEFIT)

($ in thousands)

2005 2004 2003

Amount $ Change % Change Amount $ Change % Change Amount

Investment income . . . . . . . . . . $ 18,236 $ (15,380 ) -46 % $ 33,616 $ 23,198 -223 % $ 10,418

Other income (loss), net . . . . . . $ (1,674 ) $ 51,685 -97 % $ (53,359 ) $ (97,418 ) -221 % $ 44,059

Interest expense . . . . . . . . . . . . $ 338,903 $ (40,118 ) -11 % $ 379,021 $ (37,499 ) -9 % $ 416,520

Income tax expense . . . . . . . . . $ 84,340 $ 73,918 709 % $ 10,422 $ (54,354 ) 84 % $ 64,776

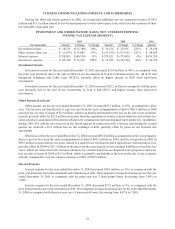

Investment Income

Investment income for the year ended December 31, 2005 decreased $15.4 million, or 46%, as compared with

the prior year primarily due to the sale in 2004 of our investments in D & E Communications, Inc. (D & E) and

Hungarian Telephone and Cable Corp. (HTCC), partially offset by higher income in 2005 from short-term

investments.

Investment income for the year ended December 31, 2004 increased $23.2 million as compared with the prior

year primarily due to the sale of our investments in D & E and HTCC and higher income from short-term

investments.

Other Income (Loss), net

Other income, net for the year ended December 31, 2005 increased $51.7 million, or 97%, as compared to prior

year. The increase is primarily due to a pre-tax loss from the early extinguishment of debt of $66.5 million in 2004

and a net loss on sales of assets of $1.9 million, which is primarily attributable to the loss on the sale of our corporate

aircraft, partially offset by $25.3 million in income from the expiration of certain retained liabilities at less than face

value, which are associated with customer advances for construction from our disposed water properties. In addition,

during 2005 $7.0 million was reserved in the fourth quarter in connection with a lawsuit, and during the second

quarter we incurred a $3.2 million loss on the exchange of debt, partially offset by gains on our forward rate

agreements

Other loss, net for the year ended December 31, 2004 increased $97.4 million as compared to prior year primarily

due to a pre-tax loss from the early extinguishment of debt of $66.5 million in 2004, and the recognition in 2003 of

$69.5 million in non-cash pre-tax gains related to a capital lease termination and a capital lease restructuring at ELI,

partially offset in 2004 by $25.3 million in income from the expiration of certain retained liabilities at less than face

value, which are associated with customer advances for construction from our disposed water properties and a net

loss on sales of assets in 2004 of $1.9 million, which is primarily attributable to the loss on the sale of our corporate

aircraft, compared to a net loss on sales of assets in 2003 of $20.5 million.

Interest Expense

Interest expense for the year ended December 31, 2005 decreased $40.1 million, or 11%, as compared with the

prior year primarily due to the retirement and refinancing of debt. Our composite average borrowing rate for the year

ended December 31, 2005 as compared with the prior year was 2 basis points lower, decreasing from 7.96% to

7.94%.

Interest expense for the year ended December 31, 2004 decreased $37.5 million, or 9%, as compared with the

prior year primarily due to the retirement of debt. Our composite average borrowing rate for the year ended December

31, 2004 as compared with the prior year was 11 basis points lower, decreasing from 8.07% to 7.96%.