Frontier Communications 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-25

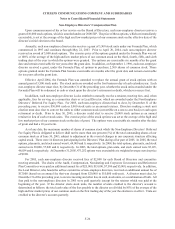

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

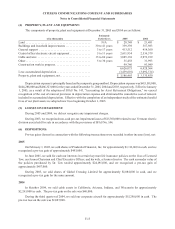

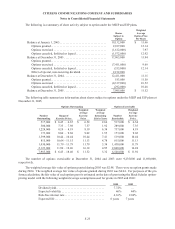

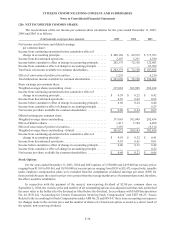

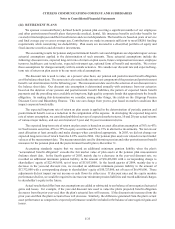

The following is a summary of share activity subject to option under the MEIP and EIP plans.

Shares

Subject to

Option

Weighted

Average

Option Price

Per Share

Balance at January 1, 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,132,000 $ 11.66

Options granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,017,000 12.14

Options exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,612,000) 7.97

Options canceled, forfeited or lapsed . . . . . . . . . . . . . . . . . . . . . (1,572,000) 12.92

Balance at December 31, 2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,965,000 11.94

Options granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — —

Options exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,411,000) 9.69

Options canceled, forfeited or lapsed . . . . . . . . . . . . . . . . . . . . . (355,000) 12.14

Effect of special, non-recurring dividend . . . . . . . . . . . . . . . . . . 2,212,000 —

Balance at December 31, 2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,411,000 11.15

Options granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 183,000 11.58

Options exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,317,000) 10.52

Options canceled, forfeited or lapsed . . . . . . . . . . . . . . . . . . . . . (292,000) 10.48

Balance at December 31, 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,985,000 $ 11.52

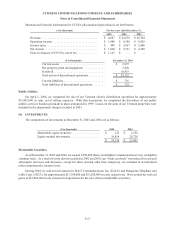

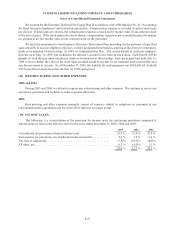

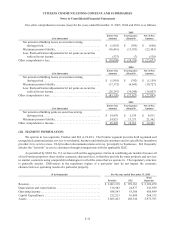

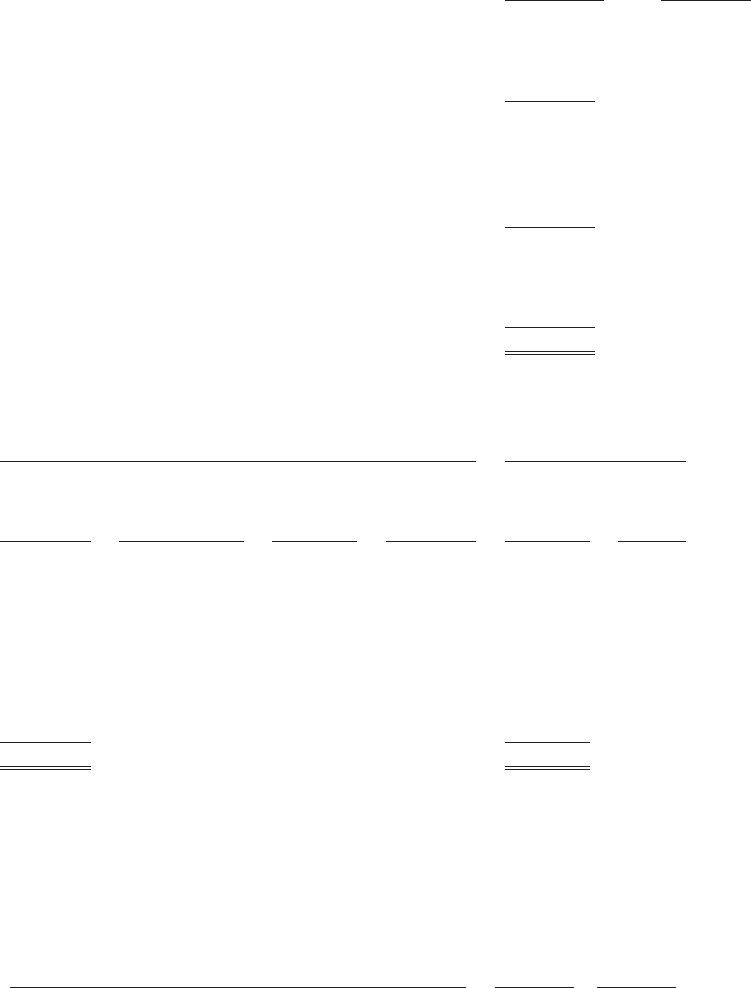

The following table summarizes information about shares subject to options under the MEIP and EIP plans at

December 31, 2005.

Options Outstanding Options Exercisable

Number

Outstanding

Range of

Exercise Prices

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Life in Years

Number

Exercisable

Weighted

Average

Exercise

Price

517,000 $ 6.45 – 6.67 $ 6.54 2.64 517,000 $ 6.54

300,000 7.33 – 7.98 7.37 1.92 289,000 7.35

1,228,000 8.19 – 8.19 8.19 6.38 737,000 8.19

173,000 8.80 – 9.68 9.02 1.55 173,000 9.02

1,399,000 10.44 – 10.44 10.44 7.41 519,000 10.44

815,000 10.64 – 11.15 11.13 4.78 815,000 11.13

1,430,000 11.79 – 11.79 11.79 5.38 1,430,000 11.79

2,123,000 11.90 – 18.46 16.14 4.95 2,068,000 16.24

7,985,000 $ 6.45 – 18.46 $ 11.52 5.32 6,548,000 $ 11.92

The number of options exercisable at December 31, 2004 and 2003 were 9,235,000 and 11,690,000,

respectively.

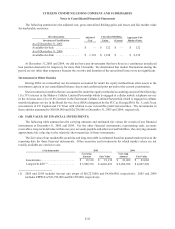

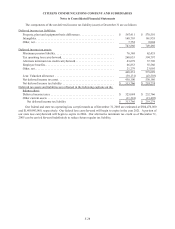

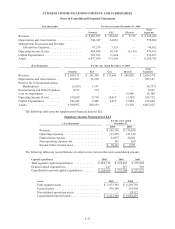

The weighted average fair value of options granted during 2005 was $2.98. There were no option grants made

during 2004. The weighted average fair value of options granted during 2003 was $6.04. For purposes of the pro

forma calculation, the fair value of each option grant is estimated on the date of grant using the Black Scholes option-

pricing model with the following weighted average assumptions used for grants in 2005 and 2003:

2005 2003

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.72% —

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46% 44%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.16% 2.94%

Expected life . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 years 7 years