Frontier Communications 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F-14

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

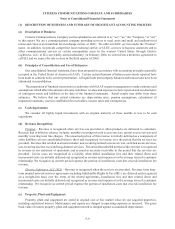

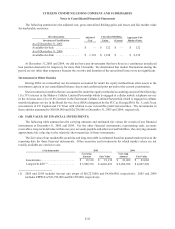

Accounting for Conditional Asset Retirement Obligations

In March 2005, the FASB issued FIN 47, “Accounting for Conditional Asset Retirement Obligations,” an

interpretation of FASB No. 143. FIN 47 clarifies that the term conditional asset retirement obligation as used in

FASB No. 143 refers to a legal obligation to perform an asset retirement activity in which the timing or method of

settlement are conditional on a future event that may or may not be within the control of the entity. FIN 47 also

clarifies when an entity would have sufficient information to reasonably estimate the fair value of an asset retirement

obligation. Although a liability exists for the removal of poles and asbestos, sufficient information is not available

currently to estimate our liability, as the range of time over which we may settle theses obligations is unknown or

cannot be reasonably estimated. The adoption of FIN 47 during the fourth quarter of 2005 had no impact on our

financial position or results of operations.

Accounting Changes and Error Corrections

In May 2005, the FASB issued SFAS No. 154, “Accounting Changes and Error Corrections,” a replacement of

APB Opinion No. 20 and FASB Statement No. 3. SFAS No. 154 changes the accounting for, and reporting of, a change

in accounting principle. SFAS No. 154 requires retrospective application to prior period’s financial statements of

voluntary changes in accounting principle, and changes required by new accounting standards when the standard does

not include specific transition provisions, unless it is impracticable to do so. SFAS No. 154 is effective for accounting

changes and corrections of errors made in fiscal years beginning after December 15, 2005.

Partnerships

In June 2005, the FASB issued EITF No. 04-5, “Determining Whether a General Partner, or the General

Partners as a Group, Controls a Limited Partnership or Similar Entity When the Limited Partners Have Certain

Rights,” which provides new guidance on how general partners in a limited partnership should determine whether

they control a limited partnership. EITF No. 04-5 is effective for fiscal periods beginning after December 15, 2005.

We do not expect the adoption of EITF No. 04-5 to have a material impact on our financial position, results of operations

or cash flows.

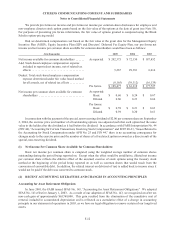

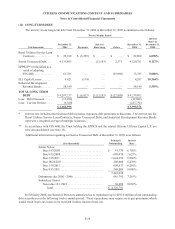

(3) ACCOUNTS RECEIVABLE:

The components of accounts receivable at December 31, 2005 and 2004 are as follows:

($ in thousands) 2005 2004

End user . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 226,717 $ 227,385

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 34,798 42,301

Less: Allowance for douptful accounts . . . . . . . . . . . . . . . (32,408) (35,996)

Accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 229,107 $ 233,690

We maintain an allowance for estimated bad debts based on our estimate of collectibility of our accounts

receivable. Bad debt expense, which is recorded as a reduction of revenue, was $13,510,000, $17,906,000 and

$21,540,000 for the years ended December 31, 2005, 2004, and 2003, respectively.