Frontier Communications 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

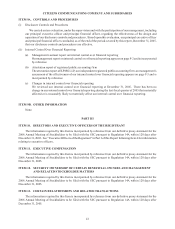

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

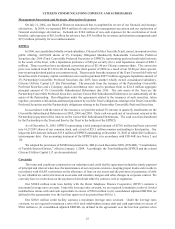

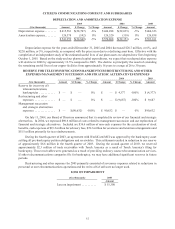

DEPRECIATION AND AMORTIZATION EXPENSE

2005 2004 2003

($ in thousands) Amount $ Change % Change Amount $ Change % Change Amount

Depreciation expense . . . . . . . . $ 415,581 $ (28,707 ) -6 % $ 444,288 $(22,035 ) -5 % $ 466,323

Amortization expense . . . . . . . . 126,378 (142 ) 0 % 126,520 (318 ) 0 % 126,838

$ 541,959 $ (28,849 ) -5% $ 570,808 $(22,353 ) -4% $ 593,161

Depreciation expense for the years ended December 31, 2005 and 2004 decreased $28.7 million, or 6%, and

$22.0 million, or 5%, respectively, as compared with the prior years due to a declining asset base. Effective with the

completion of an independent study of the estimated useful lives of our plant assets we adopted new lives beginning

October 1, 2005. Based on the study and our planned capital expenditures, we expect that our depreciation expense

will decline in 2006 by approximately 12.5% compared to 2005. The decline is principally the result of extending

the remaining useful lives of our copper facilities from approximately 16 years to a range of 26 to 30 years.

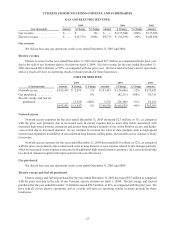

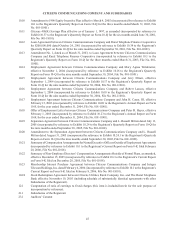

RESERVE FOR TELECOMMUNICATIONS BANKRUPTCIES/RESTRUCTURING AND OTHER

EXPENSES/MANAGEMENT SUCCESSION AND STRATEGIC ALTERNATIVES EXPENSES

($ in thousands)

2005 2004 2003

Amount $ Change % Change Amount $ Change % Change Amount

Reserve for (recovery of)

telecommunications

bankruptcies . . . . . . . . . . . $ — $ — 0 % $ — $ 4,377 -100 % $ (4,377 )

Restructuring and other

expenses . . . . . . . . . . . . . . $ — $ — 0 % $ — $ (9,687 ) -100 % $ 9,687

Management succession

and strategic alternatives

expenses . . . . . . . . . . . . . . $ — $ (90,632 ) -100% $ 90,632 $ — 0% $ 90,632

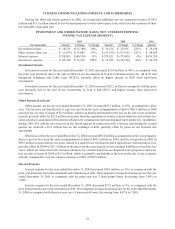

On July 11, 2004, our Board of Directors announced that it completed its review of our financial and strategic

alternatives. In 2004, we expensed $90.6 million of costs related to management succession and our exploration of

financial and strategic alternatives. Included are $36.6 million of non-cash expenses for the acceleration of stock

benefits, cash expenses of $19.2 million for advisory fees, $19.3 million for severance and retention arrangements and

$15.5 million primarily for tax reimbursements.

During the fourth quarter of 2003, an agreement with WorldCom/MCI was approved by the bankruptcy court

settling all pre-bankruptcy petition obligations and receivables. This settlement resulted in reduction to our reserve

of approximately $6.6 million in the fourth quarter of 2003. During the second quarter of 2003, we reserved

approximately $2.3 million of trade receivables with Touch America as a result of Touch America’s filing for

bankruptcy. These receivables were generated as a result of providing ordinary course telecommunication services.

If other telecommunications companies file for bankruptcy, we may have additional significant reserves in future

periods.

Restructuring and other expenses for 2003 primarily consisted of severance expenses related to reductions in

personnel at our telecommunications operations and the write-off of software no longer used.

LOSS ON IMPAIRMENT

($ in thousands) 2003

Amount

Loss on impairment . . . . . . . . . . $ 15,300