Frontier Communications 2005 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

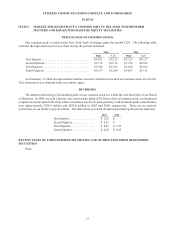

Management Succession and Strategic Alternatives Expenses

On July 11, 2004, our Board of Directors announced that it completed its review of our financial and strategic

alternatives. In 2004, we expensed $90.6 million of costs related to management succession and our exploration of

financial and strategic alternatives. Included are $36.6 million of non-cash expenses for the acceleration of stock

benefits, cash expenses of $19.2 million for advisory fees, $19.3 million for severance and retention arrangements and

$15.5 million primarily for tax reimbursements.

EPPICS

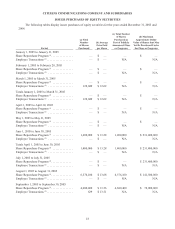

In 1996, our consolidated wholly-owned subsidiary, Citizens Utilities Trust (the Trust), issued, in an underwritten

public offering, 4,025,000 shares of 5% Company Obligated Mandatorily Redeemable Convertible Preferred

Securities due 2036 (Trust Convertible Preferred Securities or EPPICS), representing preferred undivided interests

in the assets of the Trust, with a liquidation preference of $50 per security (for a total liquidation amount of $201.3

million). These securities have an adjusted conversion price of $11.46 per Citizens common share. The conversion

price was reduced from $13.30 to $11.46 during the third quarter of 2004 as a result of our $2.00 per share special,

non-recurring dividend paid on our common stock. The proceeds from the issuance of the Trust Convertible Preferred

Securities and a Company capital contribution were used to purchase $207.5 million aggregate liquidation amount of

5% Partnership Convertible Preferred Securities due 2036 from another wholly owned consolidated subsidiary,

Citizens Utilities Capital L.P. (the Partnership). The proceeds from the issuance of the Partnership Convertible

Preferred Securities and a Company capital contribution were used to purchase from us $211.8 million aggregate

principal amount of 5% Convertible Subordinated Debentures due 2036. The sole assets of the Trust are the

Partnership Convertible Preferred Securities, and our Convertible Subordinated Debentures are substantially all the

assets of the Partnership. Our obligations under the agreements related to the issuances of such securities, taken

together, constitute a full and unconditional guarantee by us of the Trust’s obligations relating to the Trust Convertible

Preferred Securities and the Partnership’s obligations relating to the Partnership Convertible Preferred Securities.

In accordance with the terms of the issuances, we paid the annual 5% interest in quarterly installments on the

Convertible Subordinated Debentures in 2005, 2004 and 2003. Only cash was paid (net of investment returns) to the

Partnership in payment of the interest on the Convertible Subordinated Debentures. The cash was then distributed

by the Partnership to the Trust and then by the Trust to the holders of the EPPICS.

As of December 31, 2005, EPPICS representing a total principal amount of $178.0 million had been converted

into 14,237,807 shares of our common stock, and a total of $23.3 million remains outstanding to third parties. Our

long-term debt footnote indicates $33.8 million of EPPICS outstanding at December 31, 2005 of which $10.5 million is

intercompany debt. Our accounting treatment of the EPPICS debt is in accordance with FIN 46R (see Notes 2 and

15).

We adopted the provisions of FASB Interpretation No. 46R (revised December 2003) (FIN 46R), “Consolidation

of Variable Interest Entities,” effective January 1, 2004. Accordingly, the Trust holding the EPPICS and the related

Citizens Utilities Capital L.P. are deconsolidated.

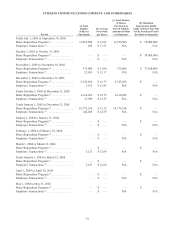

Covenants

The terms and conditions contained in our indentures and credit facility agreement include the timely payment

of principal and interest when due, the maintenance of our corporate existence, keeping proper books and records in

accordance with GAAP, restrictions on the allowance of liens on our assets and the provision of guarantees of debt

by our subsidiaries, and restrictions on asset sales and transfers, mergers and other changes in corporate control. We

currently have no restrictions on the payment of dividends either by contract, rule or regulation.

Our $200.0 million term loan facility with the Rural Telephone Finance Cooperative (RTFC) contains a

maximum leverage ratio covenant. Under the leverage ratio covenant, we are required to maintain a ratio of (i) total

indebtedness minus cash and cash equivalents in excess of $50.0 million to (ii) consolidated adjusted EBITDA (as

defined in the agreements) over the last four quarters of no greater than 4.00 to 1.

Our $250.0 million credit facility contains a maximum leverage ratio covenant. Under the leverage ratio

covenant, we are required to maintain a ratio of (i) total indebtedness minus cash and cash equivalents in excess of

$50.0 million to (ii) consolidated adjusted EBITDA (as defined in the agreement) over the last four quarters of no