Frontier Communications 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

(2) Includes restricted shares withheld (under the terms of grants under employee stock compensation plans) to

offset minimum tax withholding obligations that occur upon the vesting of restricted shares. The Company’s

stock compensation plans provide that the value of shares withheld shall be the average of the high and low

price of the Company’s common stock on the date the relevant transaction occurs.

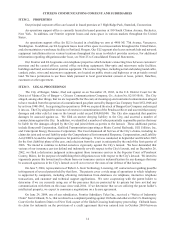

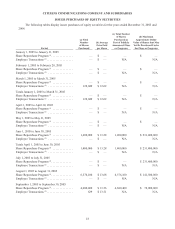

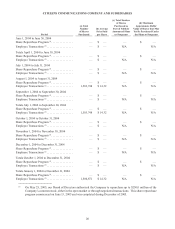

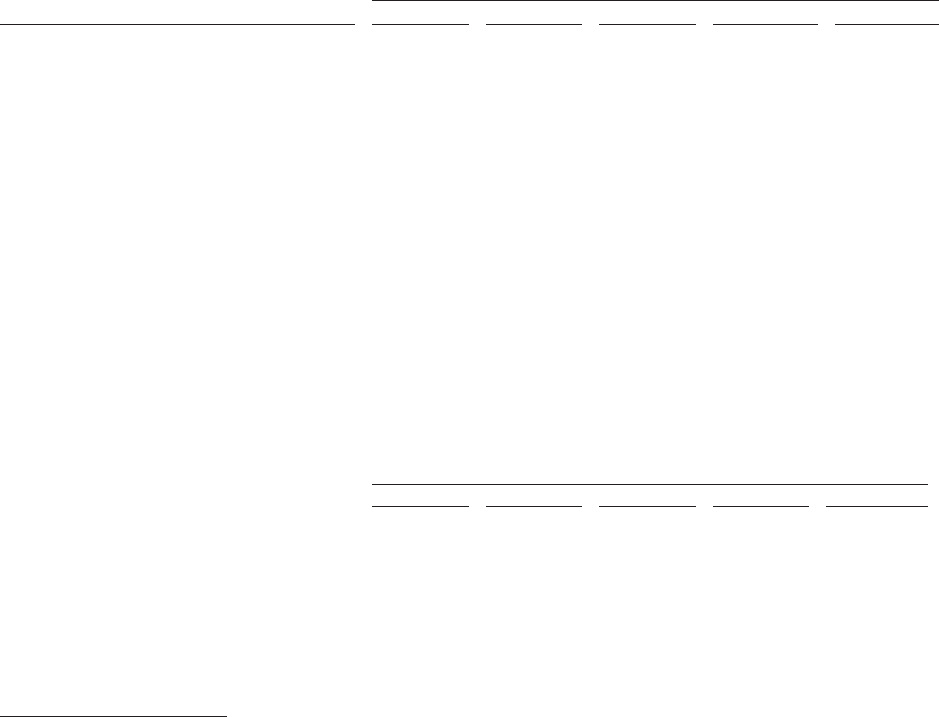

ITEM 6. SELECTED FINANCIAL DATA

($ in thousands, except per share amounts)

Year Ended December 31,

2005 2004 2003 2002 2001

Revenue (1) . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,162,479 $ 2,168,422 $ 2,424,174 $ 2,647,671 $ 2,435,489

Income (loss) from continuing operations

before extraordinary expense and

cumulative effect of changes in

accounting principle (2) . . . . . . . . . . . . . $ 200,168 $ 66,919 $ 117,703 $ (828,140 ) $ (68,434 )

Net income (loss) . . . . . . . . . . . . . . . . . . . . $ 202,375 $ 72,150 $ 187,852 $ (682,897 ) $ (89,682 )

Basic income (loss) per share of common

stock from continuing operations before

extraordinary expense and cumulative

effect of changes in accounting

principle (2) . . . . . . . . . . . . . . . . . . . . . . . $ 0.59 $ 0.22 $ 0.42 $ (2.95 ) $ (0.30 )

Available for common shareholders per

basic share . . . . . . . . . . . . . . . . . . . . . . . $ 0.60 $ 0.24 $ 0.67 $ (2.43 ) $ (0.38 )

Available for common shareholders per

diluted share . . . . . . . . . . . . . . . . . . . . . $ 0.60 $ 0.23 $ 0.64 $ (2.43 ) $ (0.38 )

Cash dividends declared (and paid) per

common share . . . . . . . . . . . . . . . . . . . . $ 1.00 $ 2.50 $ — $ — $ —

As of December 31,

2005 2004 2003 2002 2001

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,412,109 $ 6,668,419 $ 7,445,545 $ 8,144,502 $ 10,551,351

Long-term debt . . . . . . . . . . . . . . . . . . . . . . $ 3,999,376 $ 4,266,998 $ 4,195,626 $ 4,957,338 $ 5,534,867

Equity units (3) . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 460,000 $ 460,000 $ 460,000

Company Obligated Mandatorily

Redeemable Convertible Preferred

Securities (4) . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ 201,250 $ 201,250 $ 201,250

Shareholders’ equity . . . . . . . . . . . . . . . . . . $ 1,041,809 $ 1,362,240 $ 1,415,183 $ 1,172,139 $ 1,946,142

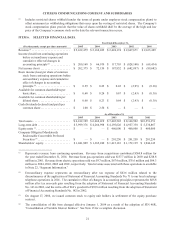

(1) Represents revenue from continuing operations. Revenue from acquisitions contributed $569.8 million for

the year ended December 31, 2001. Revenue from gas operations sold was $137.7 million in 2003 and $218.8

million in 2001. Revenue from electric operations sold was $9.7 million, $67.4 million, $76.6 million and $94.3

million in 2004, 2003, 2002 and 2001, respectively. Total revenue associated with these operations is available

in Note 22, “Segment Information.”

(2) Extraordinary expense represents an extraordinary after tax expense of $43.6 million related to the

discontinuance of the application of Statement of Financial Accounting Standards No. 71 to our local exchange

telephone operations in 2001. The cumulative effect of changes in accounting principles represents the $65.8

million after tax non-cash gain resulting from the adoption of Statement of Financial Accounting Standards

No. 143 in 2003, and the write-off of ELI’s goodwill of $39.8 million resulting from the adoption of Statement

of Financial Accounting Standards No. 142 in 2002.

(3) On August 17, 2004, we issued common stock to equity unit holders in settlement of the equity purchase

contract.

(4) The consolidation of this item changed effective January 1, 2004 as a result of the adoption of FIN 46R,

“Consolidation of Variable Interest Entities.” See Note 15 for a complete discussion.